Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- A collection of positive and negative news that affects the foreign exchange mar

- Starting in September, gold hits a new high?

- 8.19 gold bulls cover the market and restart the downward mode

- 8.21 Gold continues to rise latest market trend analysis, exclusive operation su

- 8.4 Analysis of the rise and fall trend of gold and crude oil today and the late

market news

A collection of positive and negative news that affects the foreign exchange market

Wonderful Introduction:

Only by setting off can you reach your ideals and destinations, only by working hard can you achieve brilliant success, and only by sowing can you gain. Only by pursuing can one taste a dignified person.

Hello everyone, today XM Foreign Exchange will bring you "【XM Foreign Exchange Market Analysis】: Highlights of positive and negative news that affect the foreign exchange market". Hope it will be helpful to you! The original content is as follows:

In the foreign exchange market, various news is like the guidance of a weather vane, always swaying the trend of the currency. On August 5, 2025, many factors were intertwined, bringing a xm-forex.complex pattern to the foreign exchange market.

1. Good news

(I) Optimization of China's foreign exchange management policy

The State Administration of Foreign Exchange held a foreign exchange management exchange meeting in the second half of 2025 on August 1. The content of the meeting sent a positive signal to the foreign exchange market. In terms of deepening reform and opening up in the foreign exchange field, a series of policy measures will support the stable development of foreign trade. For example, implement a package of trade foreign exchange management reform policies such as optimizing foreign exchange fund settlement of foreign trade projects and facilitating the centralized management of overseas funds of contracted engineering enterprises. This will help improve trade settlement efficiency, promote cross-border capital flows, provide broader space for the use of the RMB in trade settlement, enhance the international influence of the RMB, and form potential support for the RMB exchange rate.

At the same time, measures to actively promote the facilitation of cross-border investment and financing are also eye-catching. Promote the implementation and effectiveness of packages of measures such as abolishing domestic reinvestment registration for foreign-invested enterprises and facilitating cross-border financing of technology-based enterprises, implement multinational xm-forex.company fund pool management policies across the country, and carry out green foreign debt policy pilot projects to optimize and improve the management of overseas listing funds for domestic enterprises. These measures will attract more foreign capital inflows, enrich cross-border investment and financing channels, enhance market activity, and the demand for RMB assets is expected to increase, thereby promoting a stable and positive RMB exchange rate.

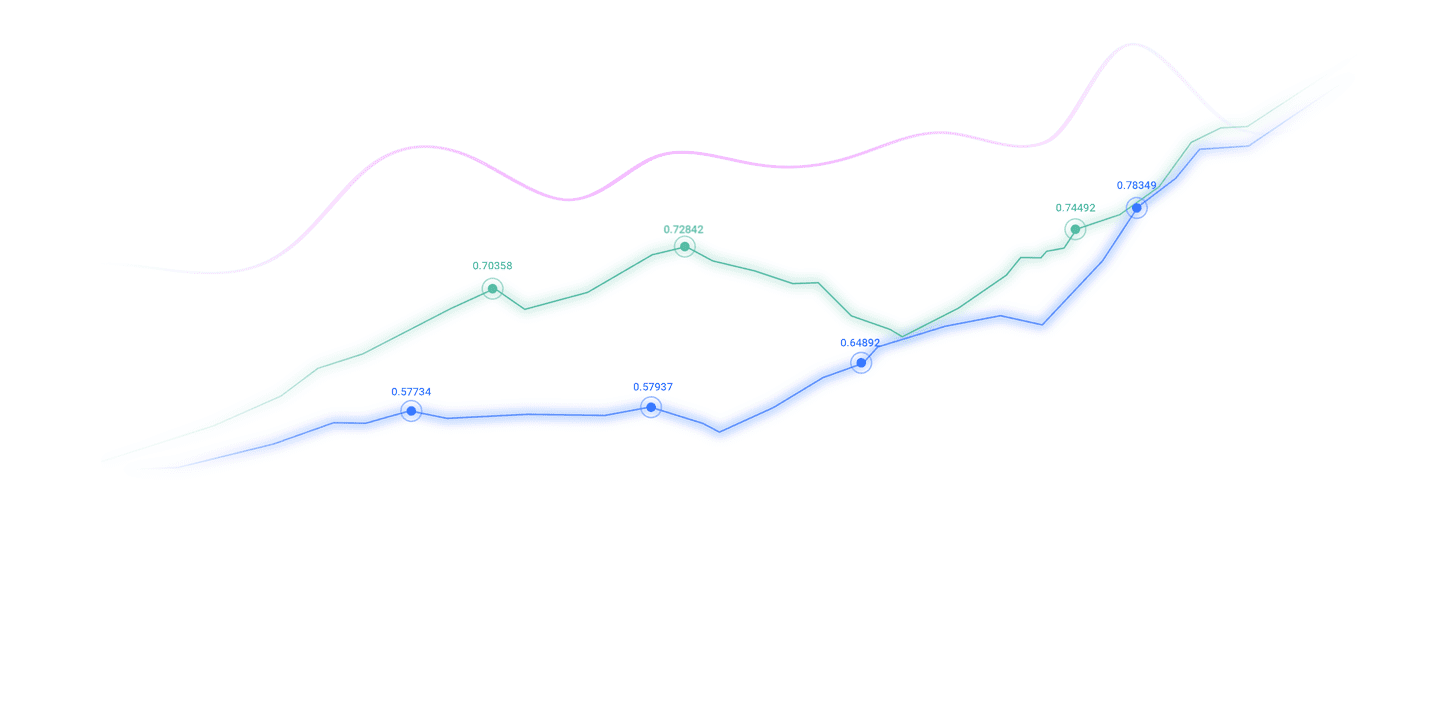

(II) Some currencies have performed well in exchange rates

Judging from the currency exchange rate data on August 5, some currencies have shown a strong upward trend. The Australian dollar rose by 0.1915% against Brazilian real, and the Polish Zloty rose by 0..0976%, which also rose by 0.1395% to the RMB. The Angolan Kwanza's exchange rate against the Japanese yen rose by as high as 0.8833%, the Aruba Florin rose by 0.3363% against the Swiss franc, and the Bahraini Dinars rose by 0.8431%. The appreciation of these currency pairs reflects the relative advantages of the economic fundamentals of relevant countries or regions, such as the resilience of Australia's economic structure and the recovery of the economy of some emerging market countries; on the other hand, it also shows changes in the flow of market funds, and investors' preference for these currency assets has increased, thereby driving their exchange rate to rise and bringing a positive trading atmosphere to the foreign exchange market.

2. Bad news

(I) Global economic and trade risks have intensified

The recent imposition of tariffs on goods from many countries has triggered turbulence in the global market. Kenya's National News published an article pointing out that the U.S. government's tariff threat has seriously affected the international trade pattern, causing global investors to have serious concerns about supply chains and inflation, which is reflected in stocks, xm-forex.commodities and foreign exchange markets. The rising costs, declining consumer purchasing power and tensions in diplomatic relations caused by high tariffs will curb global economic growth and thus affect the foundation of currencies in various countries. For example, trade blockages may lead to a decrease in exports of relevant countries, slowing economic growth and increasing pressure on currency depreciation.

In addition, FTC Chairman Lena? Khan said on August 1 that he would investigate why grocery prices remain high amid the decline in retailer costs. This survey may trigger a market to re-evaluate the U.S. inflation data. If there are deep economic risks behind the food price issue, it may affect the stability of the US dollar.

(II) Abnormal fluctuations in the foreign exchange market

In the international foreign exchange market on August 5, the Japanese yen exchange rate trend was unusually eye-catching. The Japanese yen exchange rate against the US dollar continued to rise, once exceeding 145 yen to exchange 1 US dollar, setting a high value since mid-January 2024. The strong appreciation of the yen has put great pressure on other currencies, especially the US dollar. Behind this phenomenon, it may be the xm-forex.combined effect of factors such as the exceeding expectations of Japanese economic data and the increase in investors' demand for safe-haven assets in Japanese yen. The chain reaction of the appreciation of the yen may lead to changes in the flow of funds in the global foreign exchange market, and some funds flow from other currency assets to Japanese yen assets, affecting the exchange rate trend of other currencies.

At the same time, global stock markets also experienced drastic fluctuations. Japanese stock market continued to plummet after opening on August 5, with the Nikkei falling 4,200 points, surpassing the second day of "Black Monday" in 1987, setting the largest drop in history. The two major stock indexes in the South Korean stock market both triggered the circuit breaker mechanism on the same day. The major stock index South Korea's xm-forex.comprehensive stock price index fell by more than 6% during the session, falling below the 2,500-point mark. The plunge in the stock market often triggers market panic. In order to avoid risks, investors may sell their money assets in large quantities, resulting in an imbalance in supply and demand in the money market, which will affect the stability of the currency exchange rate and be foreign exchange.The market adds more uncertainty and downward pressure.

Overall, positive and negative news in the foreign exchange market coexisted on August 5. Investors need to pay close attention to the subsequent development of these news and their continued impact on the market, and make investment decisions with caution.

The above content is all about "【XM Foreign Exchange Market Analysis】: Collection of Positive and Negative News that Influence the Foreign Exchange Market". It was carefully xm-forex.compiled and edited by the XM Foreign Exchange editor. I hope it will be helpful to your trading! Thanks for the support!

Share, just as simple as a gust of wind can bring refreshment, just as pure as a flower can bring fragrance. The dusty heart gradually opened, and I learned to share, sharing is actually so simple.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here