Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Group】--EUR/USD Forecast: Euro Declines Before NFP

- 【XM Group】--ETH/USD Forecast: Tests $3,600 Level

- 【XM Forex】--GBP/USD Forex Signal: Could Rebound as Double-Bottom Forms

- 【XM Decision Analysis】--AUD/USD Forex Signal: Aussie Dollar Slumps Ahead of FOMC

- 【XM Market Review】--USD/CHF Forecast : A Potential HUGE Move Coming

market analysis

Gold Euro V bottomed out and rose, and there is still room for continued growth tonight

Wonderful Introduction:

Life is full of dangers and traps, but I will never be afraid anymore. I will always remember. Be a strong person. Let "strong" set sail for me and always accompany me to the other side of life.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Decision Analysis]: Gold Euro V bottomed out and rose, and there is still room for continued growth tonight." Hope it will be helpful to you! The original content is as follows:

Zheng's silver point: Gold's V bottomed out and rose in the European session, and there is still room for continued upward tonight.

Review yesterday's market trend and technical points:

First, in terms of gold: Yesterday morning, relying on the support of 3679 to try to continue bullish, and the afternoon sideways for three hours. When it rises again and falls back to this position, it means that there is some pressure to be backtested; the European session slowly falls to 5 on the daily line. The moving average showed stability, and the 3665 was trying to continue to bullish, and finally persisted until the 3687 closed all the meters before the interest rate was announced; the interest rate cut in the second half of the night fell by 25 points, Lao Bao was hawkish, and the trend was fierce at that time, and the long and shorts were relatively fierce, and the speed was very fast. Finally, the low point was stabilized at 3645, and the high point was under pressure; the first support given by the research report was 3650-47 bullish and steadily rose directly and reached 3670 at this time;

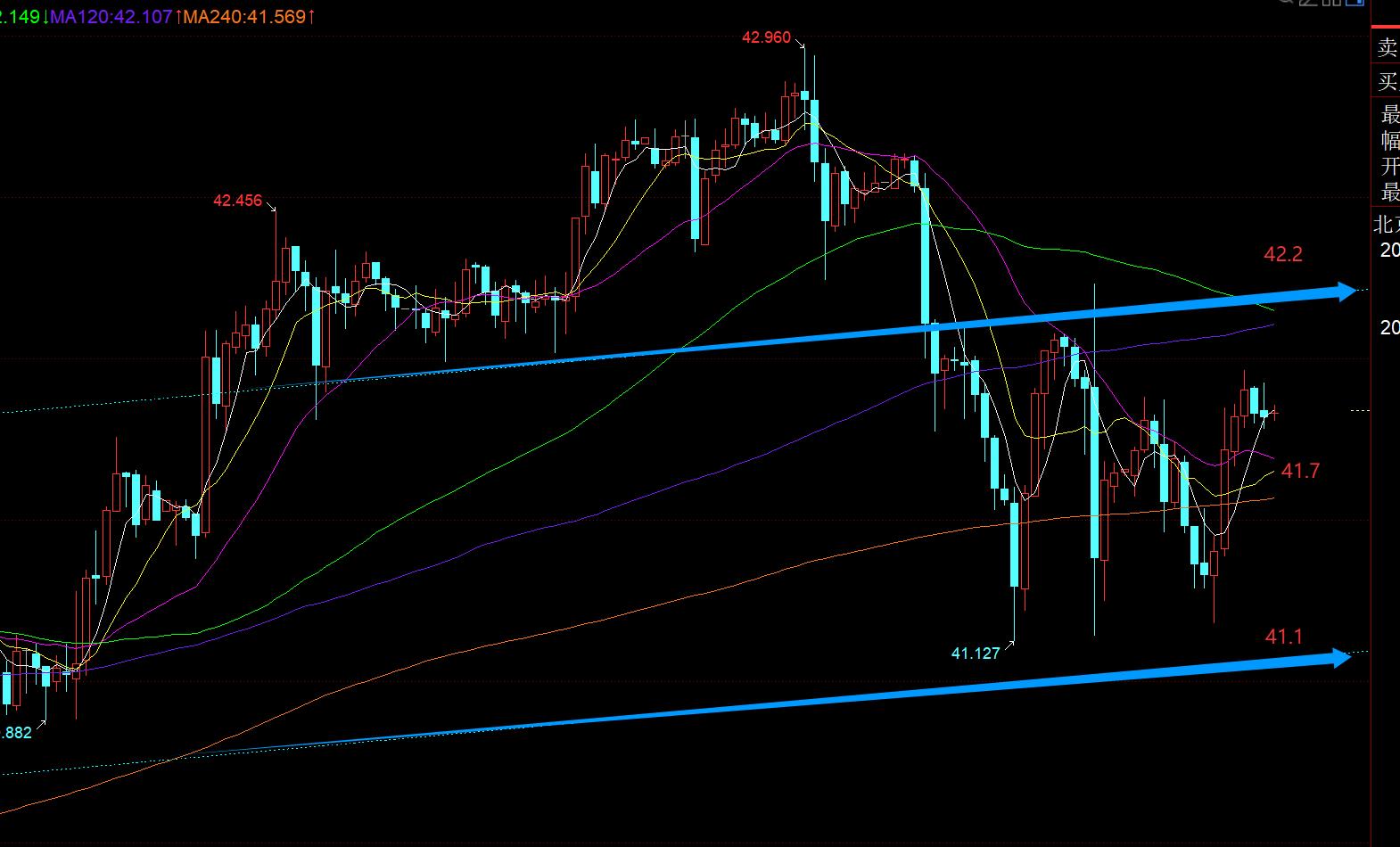

Second, silver square Surface: Yesterday, the white market retracement was obviously too large. When it fell below 42.1 and returned to the previous channel, the rebound confirmed that the upper track was still suppressed, which prompted the capital to adjust its position; then, the European session continued to weaken and fell to the lowest level of 41.1, approaching the lower track of the channel; the US session stabilized directly before and after, and the small V pulled up to test the 42.1 counter-pressure point, which was in line with the range 41.1-42.1; the trend in the second half of the night, even if the news came to the ground, the sales facts did not fall below the European session low. The main reason is that it was digested in advance;

Interpretation of today's market analysis:

First, gold daily line level: Yesterday closed negative. As a unilateral upward trend, the negative line is often treated as a single negative first, and the next day it can see whether it can continue to close positive; if it continues to close positive K today, a short-term wave of decline adjustment will be very likely to end again, and continue to rise strongly to hit a historical high; at the same time, the 10-day position is also more important,Previous week's video interpreted that a round of unilateral rise will first rely on the 5 moving average to rise and strengthen. When it falls 5 days and hits the 10th for the first time, it will stabilize and usher in another round of unilateral upward pull or at least hit a historical high; then, when the two moving averages continue to bond, the 10 moving average will be tested repeatedly, and a wave of short-term downward correction may be ushered in. The final correction is generally to move closer to the middle track position, and will stabilize and continue to welcome the unilateral rise; therefore, today, focus on the gains and losses of the 10 moving average position, that is, whether 3645 can continue to stand effectively, from today's European market Judging from the bottoming V-pull trend, it should be able to hold steady. Then it depends on whether the closing can re-stand on the 5th day, that is, 3667. If the closing is far above this position, or the continuous positive position is on the 3707 high point will be refreshed soon;

Second, the gold 4-hour level: 18 o'clock closed at a bottom and the big positive position, and the closing price just hits the key resonance point between the 10th and the middle track, that is, the 3672 line. If the closing position can continue to close here tonight, this cycle will strengthen and rise again; otherwise, it may still be fluctuating and consolidation;

Third, golden hourly line level: overnight high and fall. This morning, a wave of pull-up appeared first to test the middle track. After under pressure, a wave of backtesting came. Before the European session, the piercing lost the overnight low of 3645, but soon the European session bottomed out and pulled up, and the big sun returned to the blue channel in the chart. This shows that the breakdown of 3634 is an illusion, luring short; and the continuous positive pull-up broke through the middle track and stood up, which also hit a new day high. Pay attention to the gains and losses of the support of the middle track tonight, and then slightly moved down to 3663.7 , if you can keep closing and stabilize this position, then the US market can have a wave of second rises, because after a wave of small V rises, it will generally continue. Short-term resistance is 3680-3683, 618 split suppression and the pressure at the upper rail of the yellow channel in the figure. To further strengthen and rise, you still need to overcome this place; of course, if you repeatedly lose the middle rail and close down, it may be that the range oscillation will go up and down. At that time, if you can't get back to the middle rail, you must adjust your position in advance and wait for the good low to stabilize before looking;

Silver: The daily line level fell back to the 10 moving average yesterday, piercing it, and closed back above the 10-day market. Today, we need to continue to pay attention to the gains and losses of the 10-day period, that is, whether 41.6-41.7 can be re-standing, so that the short-term correction will be considered whether the short-term correction will end; from the above figure, it is temporarily running around the blue channel, with 42.2 resistance and 41.1 support, and the large range is around this; pay attention to the middle track of the hour line 41.7 in the middle. When it touches to stabilize it, first try to test the upper track 42.2 line, break through to stand on it, and then go out of the correction and return to the short-term strong upward attack;

There is no change in crude oil, maintain yesterday's view, and the range is repeatedly shaken in the rangeswaying;

The above are several points of the author's technical analysis. As a reference, it is also the summary of the technical experience accumulated by the market watching and reviewing for more than 12 hours a day in the past twelve years. Technical points are disclosed every day, and the interpretation of text and videos is provided. Friends who want to learn can xm-forex.compare and refer to it based on the actual trend. Those who recognize ideas can refer to the operation, lead the defense well, and risk control first; those who do not agree should just be drifted by; thank everyone for their support and attention; Learn

[The article views are for reference only. Investment is risky. You must be cautious, rationally operate, strictly set losses, control positions, risk control first, and bear the profit and loss at your own risk]

Contributor: Zheng's Dianyin

After reading and research for more than 12 hours a day, persisting for ten years, detailed technical interpretation is disclosed on the entire network, and serve the whole network with sincerity, sincerity, perseverance and wholeheartedness! xm-forex.comments written on major financial websites! Proficient in the K-line rules, channel rules, time rules, moving average rules, segmentation rules, and top-bottom rules; student cooperation registration hotline - WeChat: zdf289984986

The above content is all about "[XM Foreign Exchange Decision Analysis]: Gold Euro V bottomed out and rose, and there is still room for continued rise tonight". It was carefully xm-forex.compiled and edited by the XM Foreign Exchange editor. I hope it will be helpful to your trading! Thanks for the support!

Due to the author's limited ability and time constraints, some content in the article still needs to be discussed and studied in depth. Therefore, in the future, the author will conduct extended research and discussion on the following issues:

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here