Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- The Fed's decision to cut interest rates is imminent, and the U.S. dollar index

- Rapidly weakening demand, peace talks weaken short-term oil price outlook

- Leading the new transformation of PoP ecology with innovative technology

- High-level embankments burst and floods were released, and gold and silver were

- Cook Mortgage "Fraudgate" Counterattack: Trump Uses Knife to Steal the Federal R

market news

The U.S. dollar index remains weak as the market awaits U.S. ADP employment data

Wonderful introduction:

Spring flowers will bloom! If you've ever experienced winter, you've experienced spring! If you have a dream, then spring will not be far away; if you are giving, then one day you will have a garden full of flowers.

Hello everyone, today XM Forex will bring you "[XM Foreign Exchange Decision Analysis]: The U.S. dollar index remains weak, and the market is waiting for the U.S. ADP employment data." Hope this helps you! The original content is as follows:

The U.S. dollar index remained weak in Asian trading on Wednesday. The U.S. dollar rebounded against the yen on Tuesday, recovering part of the previous trading day's losses; the euro remained stable after the release of euro zone inflation data. The U.S. dollar index fluctuates within a narrow range, and market bets on the Federal Reserve's interest rate cut in December have increased significantly, with the probability rising to 87.2%. Weak U.S. manufacturing PMI data strengthened easing expectations, making investors pay more attention to the upcoming ADP employment and ISM service industry data to assess economic momentum and policy prospects. This week's key data will affect the trend of the US dollar and market sentiment.

Analysis of major currency trends

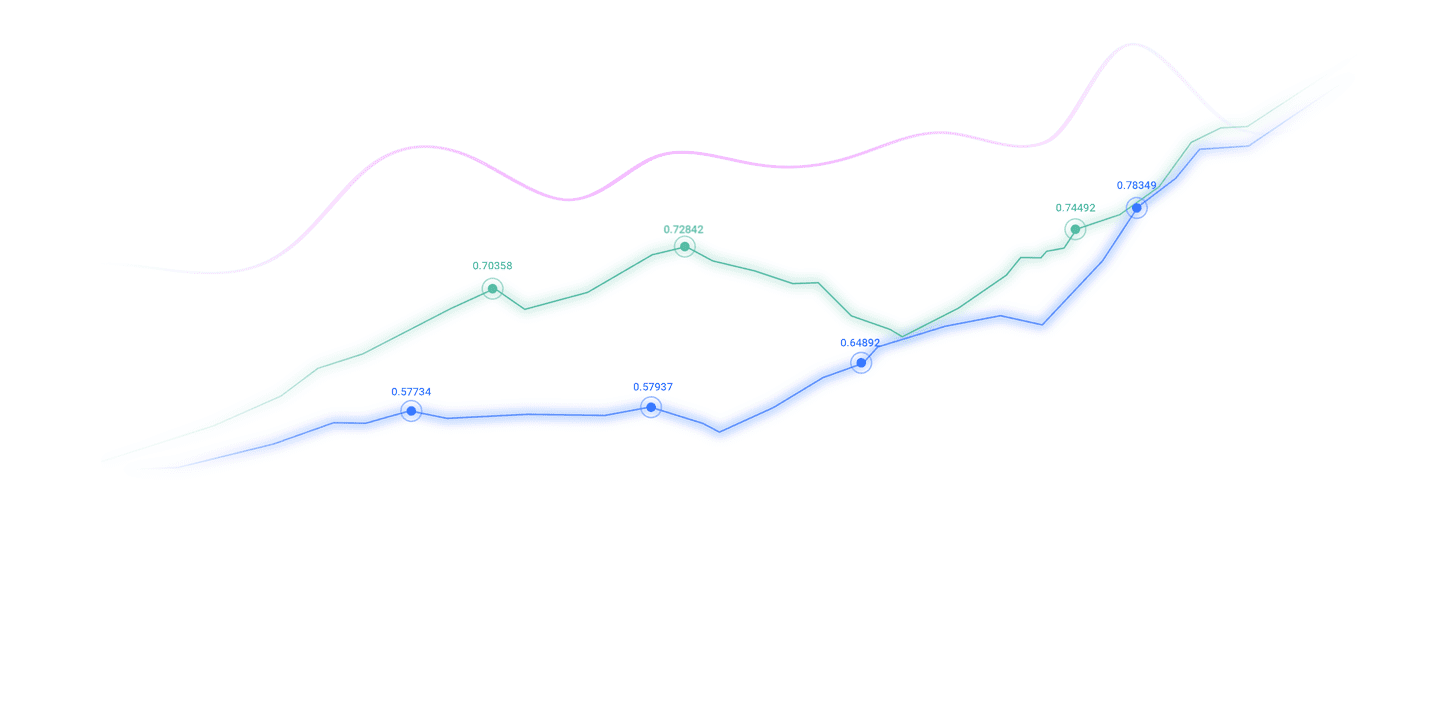

U.S. dollar: As of press time, the U.S. dollar index fluctuated around 99.26. Against the background of pressure on the production side, investor sentiment is biased towards caution, while maintaining a wait-and-see approach to the mid-term direction of the U.S. dollar. Looking ahead to this week, the market focus will turn back to the U.S. ADP employment data in November and the ISM services PMI. These two data will provide investors with an important basis for judging the prosperity of the labor market and service industry. Observed from the daily level, the U.S. dollar index entered a sideways consolidation pattern after falling below the short-term moving average. The K-line fluctuated around the 99.30-99.60 range, and the MACD remained low and glued, indicating a lack of momentum; if it falls further below 99.00, it will open up room for a correction to the 98.50 area, and the first pressure level above focuses on the 100.00 integer mark. Only an effective breakthrough can restart the rebound rhythm.

1. United Nations report: Financial fluctuations may endanger global trade and put the global economy "on the brink of crisis"

The "2025 Trade and Development Report" released by the United Nations Conference on Trade and Development (UNCTAD) on December 2 predicts that global economic growth will slow down to 2.6% in 2025, lower than 2.9% in 2024. The report focuses on the impact of finance on trade, pointing out that financial market fluctuations have almost as much impact on global trade as real economic activities and affect global development prospects. Greenspan, Secretary-General of the United Nations Conference on Trade and Development, said that the research results show that the financial environment is increasingly dominating the trend of global trade. “Trade is not only a supply chain, but also a supply chain.It is the connection between credit lines, payment systems, money markets and capital flows. ”

2. The Trump administration removed the word “renewable” from the name of a U.S. energy laboratory

The Trump administration changed the name of a U.S. energy laboratory and removed the word “renewable” from its name. This is the latest move by the government to downplay the importance of electricity sources such as solar and wind energy in favor of fossil fuels. The U.S. National Renewable Energy Laboratory (original name) in Golden, Colorado, announced on its official website on Monday evening that the laboratory has now been renamed "National Laboratory of the Rockies". As one of the 17 laboratories under the U.S. Department of Energy, the laboratory is also dedicated to energy. Efficiency research. It was founded by former U.S. leaders, including two members of Trump’s Republican Party.

3. Trump may announce the candidate for the new Federal Reserve Chairman early next year.

U.S. President Trump said at a cabinet meeting at the White House on December 2 that he is likely to announce the next U.S. Federal Reserve Chairman in early 2026. Trump also confirmed on the same day that U.S. Treasury Secretary Bessent has no intention to serve as chairman of the Federal Reserve Board. According to people familiar with the matter, the White House National Economic Council has made a decision. Chairman of the Federal Reserve Board Kevin Hassett is the top candidate for the next chairman of the Federal Reserve. According to relevant laws, the US president must be approved by the Senate after he was nominated as the chairman of the Federal Reserve during Trump’s first presidential term. After taking office in February 2018, Trump was publicly criticized for the Fed’s monetary policy. xm-forex.comment on Powell. After taking office again in January this year, Trump repeatedly criticized Powell, accused the Federal Reserve of cutting interest rates too slowly, and threatened to remove Powell from his position.

4. Russia does not accept Europe’s revision of the Russia-Ukraine peace plan

Russian President Putin said in an interview with the media on December 2. He said that Russia cannot accept the changes that Europe is trying to make to the "peace plan" proposed by the United States. Putin pointed out that Europe is trying to make some changes to the "peace plan" for Russia and Ukraine in order to obstruct the peace process, and in this way he hopes to shift the responsibility for the collapse of the Ukraine peace process to Russia. Russia is ready to respond to a sudden war. On November 20, the US media disclosed the 28-point Russia-Ukraine "peace plan" drafted by the White House. The plan was considered by Ukraine and Europe to be biased towards Russia. On November 23, representatives of the United States, Ukraine and Europe held talks in Geneva, Switzerland, to significantly modify the plan.

5. Putin: Russia in 2025.The Russian economy will have a soft landing and the inflation rate will be lower than expected

Russian President Putin said at the 16th VTB "Russia is Calling!" Investment Forum that Russia's inflation rate will be lower than expected in 2025 and is expected to remain around 6%; GDP growth is expected to be between 0.5% and 1%, which is an expected soft landing, but the economy has already seen some imbalances. Putin emphasized, “I would like to remind everyone that the fundamental task set for the government and the central bank in December last year is to ensure the transition to a balanced growth model: while maintaining low unemployment and low inflation levels, initiate structural reforms of the economy, and take into account the direction of economic formalization and the strengthening of the xm-forex.competitive environment.” “We will discuss this topic in detail at the meeting of the Strategic Development and State Projects xm-forex.committee in a week,” Putin concluded.

Institutional Views

1. Mitsubishi UFJ: The yen may gradually recover in response to expectations of interest rate hikes

Lee Hardman, an analyst at Bank of Mitsubishi UFJ, pointed out that as the Bank of Japan is expected to resume interest rate hikes at its next meeting, the yen may gradually recover next year. Bank of Japan Governor Kazuo Ueda made it clear on Monday that he would raise interest rates at the December 19 meeting. Hardman said expectations for a rate hike were further strengthened as Japanese officials did not express opposition to the move. "Ueda recently held talks with Finance Minister Katayama Satsuki, Economy and Finance Minister Akinobu Kiuchi and Prime Minister Takaichi Sanae, indicating that he has been authorized to release a signal to raise interest rates this month," he said.

2. ING: The slight rise in Eurozone inflation makes the ECB’s December decision more clear

ING economist Bert Crane pointed out that the slight rise in Eurozone inflation does not provide the ECB with a reason to cut interest rates in December. The overall inflation rate rose to 2.2% from 2.1% in November, while the core inflation rate remained stable at 2.4%. Clariant said the slight rise in inflation was mainly due to the narrowing of the decline in energy prices. "The current slowdown in inflation and inflation drivers seem to be balancing each other, keeping price levels at too high a level, making it difficult to support further interest rate cuts." Looking ahead, xm-forex.companies expect prices to rise at an accelerated pace, especially in the service industry. However, Clariant believes that in the foreseeable future, deflationary pressure will still keep prices close to current levels, and inflation may even fall below the target value in the xm-forex.coming months.

3. Deutsche Bank: If the next chairman of the Federal Reserve fails to effectively deal with inflation risks, the US dollar may face downward pressure

Deutsche Bank analyst Antje Plavke pointed out that if the next chairman of the Federal Reserve still responds to US President Trump’s interest rate cut proposals when inflation is high, the US dollar may face downward pressure. Hassett, who is expected to be nominated as director of the White House National Economic Council, is seen as a loyal supporter of Trump, which Plavke believes increases the possibility of the Fed cutting interest rates. If the Fed fails to effectively curb inflation risks, it will have a negative impact on the currency. While that hasn't happened yet, "market expectations alone that the Fed may take a looser stance on inflation are enough to weigh on the dollar," she said.

The above content is aboutThe entire content of "[XM Foreign Exchange Decision Analysis]: The U.S. dollar index remains weak, the market awaits U.S. ADP employment data" was carefully xm-forex.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

In fact, responsibility is not helpless or boring, it is as gorgeous as a rainbow. It is this colorful responsibility that creates the wonderful life we have today. I will try my best to organize the article.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here