Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- November 18th practical foreign exchange strategy

- Weekly increases and weekly decreases, this "death cross" employment data scared

- Oil prices fell on hopes of peace between Russia and Ukraine, investors took pro

- The US-Russia summit falls into Rashomon, who will take the lead in gold?

- Bond yields "conquer an army" and the US dollar falls into a passive position

market analysis

Gold continues to fluctuate upward. Tonight, focus on the daily convergence triangle and the upper rail.

Wonderful introduction:

Life requires a smile. When you meet friends and relatives, smiling back can cheer up people's hearts and enhance friendship; accepting help from strangers and smiling back will make both parties feel better; give yourself a smile and life will be better!

Hello everyone, today XM Forex will bring you "[XM Group]: Gold continues to fluctuate upward, and tonight we will focus on the daily convergence triangle upper track". Hope this helps you! The original content is as follows:

Zheng's Point of View: Gold continues to fluctuate upward, and tonight we will focus on the daily convergence triangle upper track

Reviewing yesterday's market trends and emerging technical points:

First, gold: it continued to rise early yesterday, and as a period of shock, the continuity is the worst. At the same time, there is trend line resistance below 4160, so if there is a pressure signal, 4150 will be the first. Bearish pullback, xm-forex.combined with the 5-minute cycle, top and bottom, and split resonance method, successively pointed out that 4138, 4135, and 4145 were bearishly pulled back, and the minimum two times were to the 4110 line. The short-term profit margin is sufficient. ; The U.S. market finds a pattern cycle, double bottom support, and then relies on the two backtests of 618 to stabilize the resonance, indicating that 4128 will follow the bullish trend and reach the 4150 target;

Second, silver: its fortune yesterday The trend xm-forex.completely relies on the yellow trend pressure line and the lower trajectory of the blue channel in the chart, oscillating up and down, so the card position will be relatively better; in the morning, it fell under pressure at 51.6, and the US market 50.8 stabilized and pulled up; during the day, it was also bearish first and then stabilized and pulled up, which was in line with predictions, and profits were captured in the back and forth shocks;

Today's market analysis and interpretation:

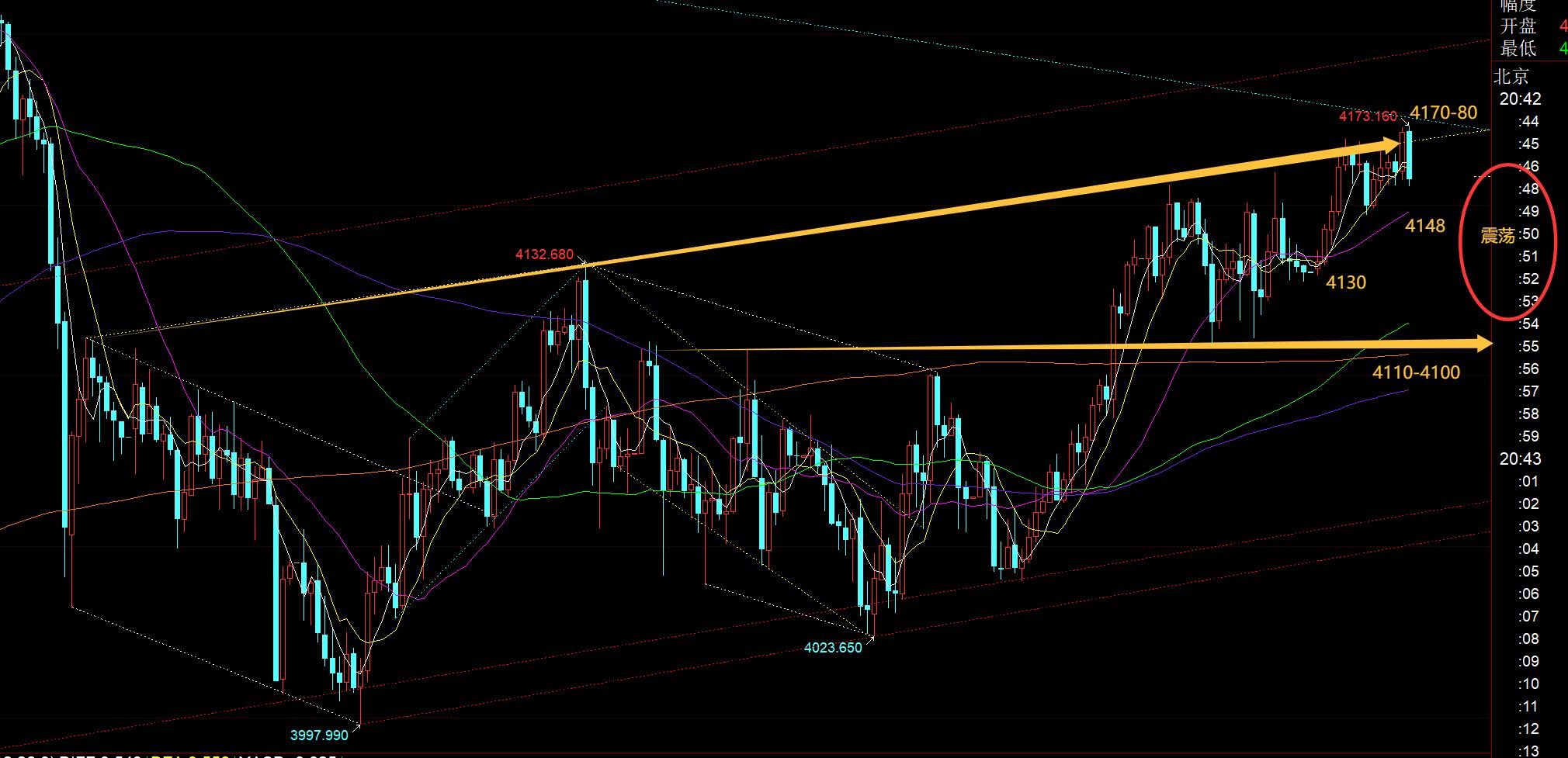

First, the gold daily level: finally tested at this moment today Approaching the upper rail of the small convergence triangle, it has moved down to 4175-78, which is the key pressure point below 4180. According to Zhou's video interpretation, if the upper rail is under pressure here, there will be a shock and fall in the next few days, and then continue to rise to test the upper rail to break through, or directly break through tonight. However, these two breakthroughs are not expected to be the kind of big unilateral continuous rise, but may cycle from April to August, with a piercing false positive, and then the next dayIt may fall back into the channel the next day, which means a new slightly larger convergence triangle will be formed to continue the wide range adjustment; if it breaks upward, pay attention to the resistance in the 4200-4245 range; personally, I hope that it will be under pressure tonight. The resistance on the upper track of the small convergence triangle is 4175-78. Tomorrow and the next two days are Thanksgiving Day, and there will be a shock fall. At the beginning of next week, it will stabilize and go up to test the convergence triangle. It will break upward. After a few days of shock and pull up, it will xm-forex.come under pressure again and form a new large convergence triangle ( At that time, the lower track of the small convergence triangle may also pierce the illusion), and then run for a few weeks, and finally return to the bull market by the end of the year or early next year;

Second, the golden 4-hour level: Although it has been supporting the 5th and 10th, it seems that The trend is strong, but there is also some stagflation. Each bar only slightly breaks a new high before falling back, and the momentum is insufficient; tonight, pay attention to 4144 on the 10th. If it loses, it will be under pressure and turn into a backtest;

Third, the golden hour line level: the overnight closing position of 4130 is just at the 618 point where yesterday's high and low points were divided. This morning, 4130 stabilized and closed on the middle track. Then 4141 decisively followed the bullish trend and successfully reached the yellow trend resistance line in the 4163-66 chart; and after the long upper shadow K fell back under pressure, 416 3. Backhand bearish, reaching the 4150 target; originally 4150-45 was planned to fluctuate the bullish position again. At that time, it closed at 15 o'clock, and it was conservatively moved down to the 618 division of 4145-44, which was pushed back by the morning wave. Unfortunately, it was a few meters short and did not give the opportunity. The European market has been repeatedly sorting around the 4150-4170 range, even at 20 o'clock The closing sun has broken through a new intraday high, and it cannot directly attack and continue. This is mainly because the short-term macd divergence is too serious, and the indicator has no momentum before it is repaired. In addition, there is still an important pressure point of 4175-78; therefore, tonight, I believe that the upper space is not large for the time being. Be careful to pursue the rise. The macd top divergence is serious and it is easy to rise and fall. You can rely on 4170- Try a bearish pullback within the 4180 range. As long as 4180 does not break through, do not chase the rise. The lower support is the 4148 middle track, which is also the rising point of the European market. If it falls below, focus on the intraday low of 4130, which is a strong support for the 4100-4110 area. If the support is lowered and stabilized, you can try a shock bullish rebound, and keep the shock within the range;

Silver: From the picture above, the upper track of the blue channel 52.5 is under pressure, which is also close to the previous high point of 52.45 to form a double top suppression. This is the cyclic probability at the end of October. Once the pressure is under today, it will start a shock-type decline in the next two days; of course, the step back is for the market to further stabilize and rise. There is a high probability that 48.6, last week's low, will not fall below again, 50-49.5 will become the next strong support; pay attention to the upper and lower resistance of 52.5 tonight, support 51.7 and 51.3, and treat it with shock;

The above are several views of the author's technical analysis. As a reference, it is also a summary of the technical experience accumulated from watching and reviewing the market for more than 12 hours a day for more than 12 years. Technical points will be disclosed every day, with text and video interpretation. Friends who want to learn can xm-forex.compare and reference based on the actual trend; those who agree with the idea can refer to the operation and take good defense. , risk control xm-forex.comes first; if you don’t agree, just let it go; thank you all for your support and attention;

[The opinions in the article are for reference only, investment is risky, you need to be cautious when entering the market, operate rationally, strictly set losses, control positions, risk control first, profit Be responsible for any loss]

Writer: Zheng Shi Dian Yin

Reading and researching the market for more than 12 hours a day, insisting on it for ten years, making detailed technical interpretations public on the entire network, and serving with sincerity, dedication, sincerity, perseverance, and wholehearted service to the end! Write xm-forex.comments on major financial websites! Proficient in K-line rules, channel rules, time rules, moving average rules, segmentation rules, and top-bottom rules; student cooperation registration hotline - WeChat: zdf289984986

The above content is all about "[XM Group]: Gold continues to fluctuate upward, and tonight we will focus on the daily convergence triangle upper track". It is carefully xm-forex.compiled and edited by the XM foreign exchange editor. I hope it will be helpful to your trading! Thanks for the support!

In fact, responsibility is not helpless or boring, it is as gorgeous as a rainbow. It is this colorful responsibility that creates the wonderful life we have today. I will try my best to organize the article.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here