Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Decision Analysis】--EUR/USD Forecast: Euro Very Noisy on Wednesday

- 【XM Group】--EUR/USD Forecast: Drops Amid Trade Spat Fears

- 【XM Decision Analysis】--Crude Oil Monthly Forecast: February 2025

- 【XM Decision Analysis】--EUR/USD Analysis: Will the Euro Rise in the Coming Days?

- 【XM Market Analysis】--GBP/USD Forex Signal: Flips Key Support as Sell-Off Contin

market news

Data turbulence disturbs the market, the gold and silver range is short first

Wonderful introduction:

Life needs a smile. When you meet friends and relatives, you can give them a smile, which can inspire people's hearts and enhance friendships. When you receive help from strangers, you will feel xm-forex.comfortable with both parties; if you give yourself a smile, life will be better!

Hello everyone, today XM Foreign Exchange will bring you "[XM Group]: Data turbulence disturbs the market, the gold and silver range is short first". Hope it will be helpful to you! The original content is as follows:

Yesterday, the gold market opened at 3660.2 in the morning and then the market first rose. The market continued to fall and pressure downward. The European session was given a position of 3633.5 and the US session rose strongly. The daily line reached a 4-hour level of 3673. The Bollinger mid-track pressure fell rapidly during the trading session. The daily line was given a position of 3627.4 and then the market consolidated. The daily line finally closed at 3644.6. The line closed with a middle-yin line with an upper and lower shadow line. After this pattern ended, today's market has continued to fall pressure. At the point, the long 3325 and 3322 below were long and 3377 and 3385 long and 3563 last week reduced positions and the stop loss followed at 3570. Today, 3667 short stop loss is 3673. The target below is 3650 and 3640 and 3632 and 3627, and the support below is 3621 and 3613-3610.

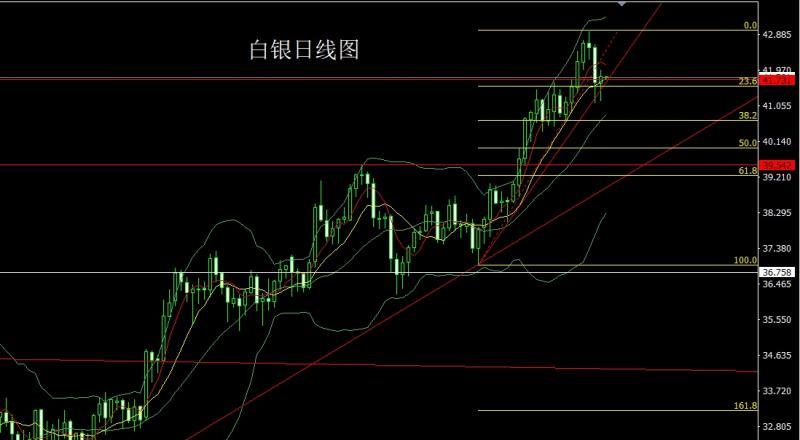

The silver market opened at 41.629 yesterday and the market first rose. The market continued to fall and pressure downward. The daily line was at the lowest point of 41.179 and then the market rose strongly. The daily line reached the highest point of 41.972 and then the market consolidated. After the daily line finally closed at 41.805, the daily line was a very long pregnancy line with a lower shadow line.The hammer head pattern ends, and after such pattern ends, the daily anti-decline signal, the long at 37.8 below the point, and the long at 38.8 on Friday, the stop loss followed up at 39.5, and the long at 41.3 today is 41.1, and the target is 41.6 and 41.8-42-42.2 pressure.

European and American markets opened at 1.18112 yesterday and the market fell first, and then the market rose strongly. The daily line reached the highest position of 1.18486 and then the market fell strongly. The daily line was at the lowest position of 1.17486 and then the market rose at the end of the trading session. After the daily line finally closed at 1.17850, the daily line ended with a spindle pattern with an upper and lower shadow line. After this pattern ended, the long position of 1.16600 and the long position of 1.17100 last week were reduced and the stop loss followed at 1.17000. Today, the target below 1.18200 short stop loss of 1.18400 is 1.17600, 1.17400 and 1.17200 are ready to leave.

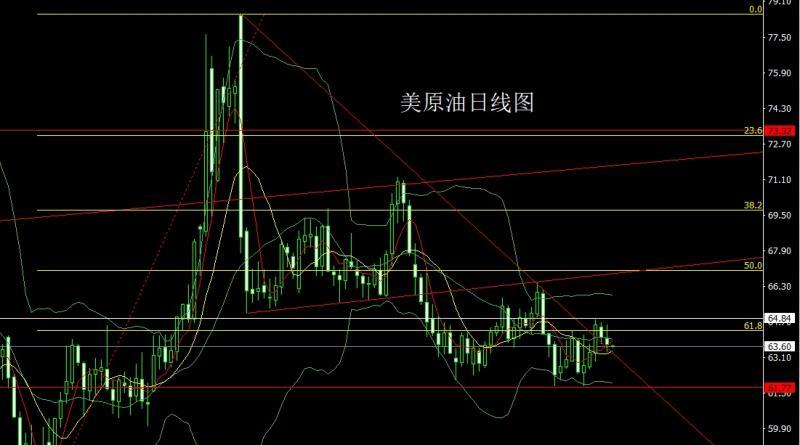

The US crude oil market opened at 63.95 yesterday and then the market consolidated in a large range. The US market was given a position of 63.35 at the beginning of the US market. After the market reached a position of 64.55 at the highest, the market fell strongly. After the daily line reached a position of 63.36 at the lowest, the daily line finally closed at 63.68. After the market closed in a spindle pattern with an upper shadow line slightly longer than the lower shadow line. After this pattern ended, the short position of 64.4 yesterday was reduced and the stop loss followed at 64.5. Today, the target below the 64.1 short stop loss is 63.8 and 63.3, and the target below the 63 and 62.8.

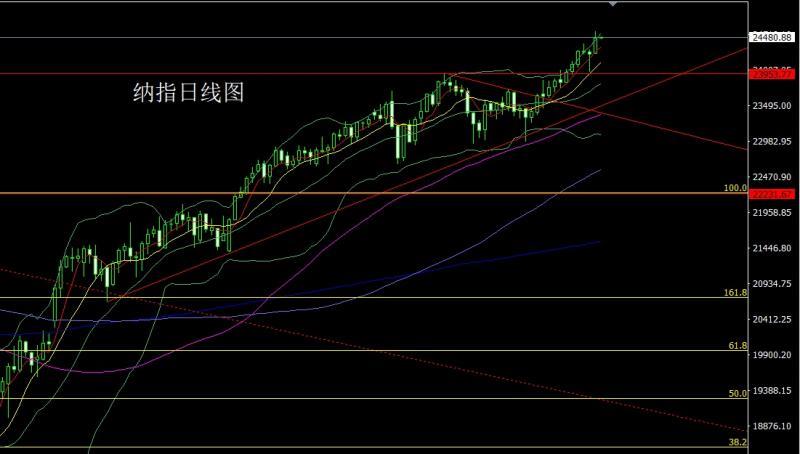

Nasdaq market opened at 24251.58 yesterday and the market fell slightly back to 24244.91. After the market rose strongly, the daily line reached the highest point of 24568.45. After the market consolidated, the daily line finally closed at 24468.39. Then the market closed with a large positive line with a longer upper shadow line. After this pattern ended, 24375 more stop loss 34300 today, and the target was 24450 and 24500 and 24550.

The fundamentals, yesterday's fundamentals, the Bank of England kept the interest rate at 4% with a 7-2 vote ratio, and reduced the pace of quantitative tightening from 100 billion pounds to 70 billion pounds. Bailey, the bank's president, said he still believes that interest rate cuts will continue. The number of initial jobless claims released by the United States hit the biggest drop in nearly four years, reversing the sharp increase in the previous week (data released)The news later said North Carolina's renewal data was wrongly underestimated by more than 19,000 people, and a spokesman for the Department of Labor said it was still investigating the matter). Therefore, the market's long-short limit conversion after the US market is mainly focused on the announcement of interest rate decisions by the Bank of Japan. At 14:30, the Bank of Japan Governor Kazuo Ueda held a monetary policy press conference.

In terms of operation, gold: 3325 and 3322 long below and 3377 and 3385 long last week, and 3563 long last week, followed by the stop loss at 3570. Today, 3667 short stop loss at 3673. The target below is 3650 and 3640 and 3632 and 3627, and the support below is 3621 and 3613-3610.

Silver: The long position of 37.8 below and the long position of 38.8 last Friday, the stop loss followed up at 39.5, and today's 41.3 long stop loss of 41.1, and the target is 41.6 and 41.8-42-42.2 pressure.

Europe and the United States: Last week, the long position of 1.16600 and the long position of 1.17100 were reduced and the stop loss followed at 1.17000. Today, the target below 1.18200 short stop loss of 1.18400 is 1.17600, 1.17400 and 1.17200 is ready to leave.

U.S. crude oil: The short position of 64.4 was reduced yesterday and the stop loss followed by 64.5. Today, the short stop loss of 64.5 is 63.8 and 63.3. The target below 64.1 is 63.8 and 63.3, and the target below 63 and 62.8.

Nasdaq: 24375 is 34300, and the target is 24450 and 24500 and 24550.

The above content is all about "[XM Group]: Data turbulence disturbs the market, the gold and silver range is short first". It was carefully xm-forex.compiled and edited by the editor of XM Forex. I hope it will be helpful to your trading! Thanks for the support!

Life in the present, don’t waste your current life in missing the past or looking forward to the future.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here