Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Market Review】--EUR/GBP Forecast: Faces Downward Pressure

- 【XM Group】--GBP/USD Forecast: Recovers Nicely

- 【XM Decision Analysis】--GBP/JPY Forecast: Drops on BoE Cut

- 【XM Market Review】--GBP/USD Forex Signal: Rebounds, But Downtrend Still Intact

- 【XM Market Review】--Gold Analysis: Stable Bullish Prices

market analysis

Boots landed to make profits, gold and silver are made short

Wonderful introduction:

Without the depth of the blue sky, there can be the elegance of white clouds; without the magnificence of the sea, there can be the elegance of the stream; without the fragrance of the wilderness, there can be the emerald green of the grass. There is no seat for bystanders in life, we can always find our own position, our own light source, and our own voice.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Official Website]: Boots land to make profits, gold and silver are big and short." Hope it will be helpful to you! The original content is as follows:

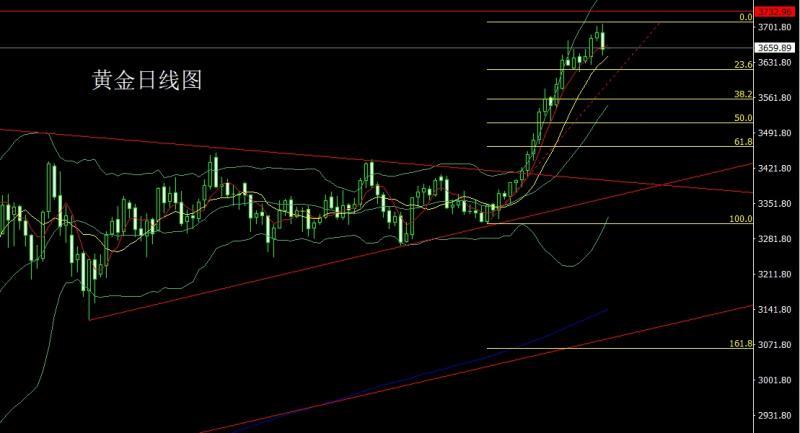

Yesterday, the gold market opened at 3690.1 and then the market rose slightly, and then the market fluctuated and fell. The US market was given a position of 3659.1 at the beginning of the market and then the market rose strongly. The daily line reached a record high of 3707.8 and then the market fell strongly at the end of the trading session. The daily line was at the lowest point of 3645.6 and then the market consolidated. After the daily line finally closed at 3657.1. The daily line was slightly longer than the upper shadow line. The big negative line of the lower shadow line closes, and after such a pattern ends, the daily line has the pressure to take profit-taking. At the point, the long 3325 and 3322 below are long and 3377 and 3385 long and 3563 last week are reduced and the stop loss follows at 3570. The early trading today first pulled up and gave 3678 short 3680 short stop loss 3685, the target is 3653 and 3645, and if it falls below, the support of the range of 3640 and 3641-3638.

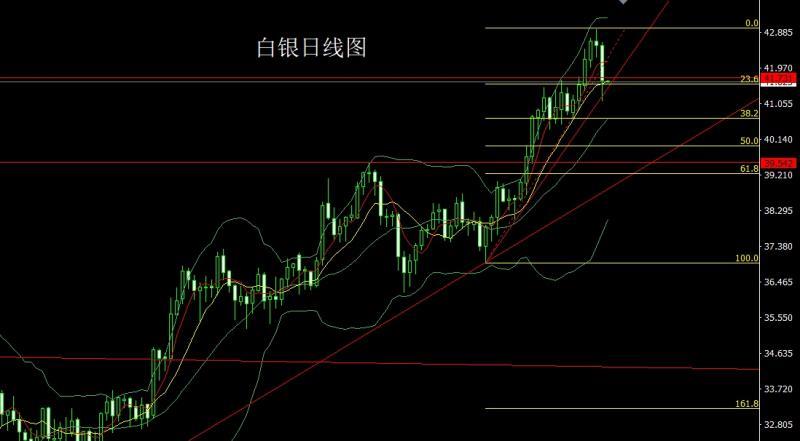

The silver market opened at 42.555 yesterday and the market rose slightly. The market fell sharply. The daily line was at the lowest point of 41.112 and then the market fluctuated in the low range. After the daily line finally closed at 41.653, the daily line closed with a large negative line with a long lower shadow line. After this pattern ended, it was 37.8 below.Long and 38.8 last Friday, the stop loss followed up after reducing positions at 39.5. Today, the first pull-up was given a short position of 42.1, and the stop loss was 42.35. The target below is 41.6 and 41.1. If it falls below, it looks at 40.8 and 40.6. If it falls below, it looks at 40.8 and 40.6.

European and American markets opened at 1.18589 yesterday and the market fluctuated and fell first. The US market started at 1.18320 and then the market fluctuated and rose. In the early morning, the Federal Reserve decided to pull up first and gave a daily high of 1.1. Then the market fell rapidly. The daily line was at the lowest point of 1.18066 and then the market consolidated. The daily line finally closed at 1.18125. Afterwards, the daily line closed with a very long upper shadow line. After this pattern ended, the daily line took short-term profits to close the signal. At the point, the long position of 1.16600 and long position of 1.17100 were reduced last week and the stop loss followed at 1.17000. Today, it first pulled up and gave a short stop loss of 1.18400 and 1.18600 target of 1.18000 and 1.17600 and 1.17350.

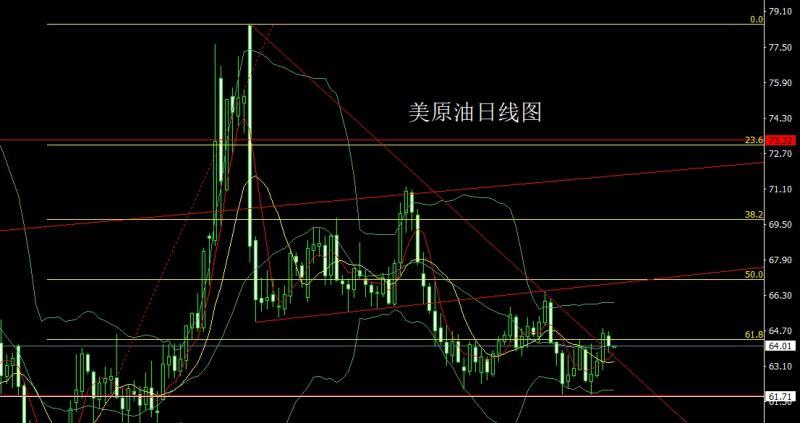

The US crude oil market opened at 64.48 yesterday and the market first rose. The daily high point of 64.67 was given a strong fluctuation and decline. The daily line was at the lowest point of 63.7 and then the market consolidated. After the daily line finally closed at 64.01, the daily line closed with a lower shadow line slightly longer than the upper shadow line. After this pattern ended, today's short stop loss of 64.8, the lower target of 64.8 is 64 and 63.7, and the falling below 63.3 and 63.

The Nasdaq market opened at 24275.14 yesterday and then fell back to 24201.42 position and then rose. The daily high of 24304.39 was given, and the market fell rapidly in the early morning. After the daily line was at the lowest point of 23987.29, it rose strongly in the late trading. After the daily line finally closed at 24244.71, the daily line was with a lower shadow line. The long opening star pattern closed, and after the end of this pattern, the stop loss of more than 24150 today was 24090, with the targets of 24300 and 24400-24450.

The fundamentals, yesterday's fundamentals market focused on the Federal Reserve's interest rate decision this morning. The content of the meeting showed that the Federal Reserve cut interest rates by 25 basis points as scheduled to 4.00%-4.25%, restarting the pace of interest rate cuts that have been suspended since December last year. Director Milan believes that interest rate cuts should be cut by 50 basis points. The dot map is expected to cut interest rates twice this year. An official expects a cumulative rate cut of 150 basis points this year, and an official (non-vote xm-forex.committee) believes thatRate cuts should not be cut in the year. At the end of 2025, 2026 and 2027, the expected median federal funds rate was lowered to 3.6%, 3.4% and 3.1%. Inflation has risen, and is still at a "slightly high" level. PCE and core PCE inflation expectations were raised to 2.6% by the end of 2026. Fed Chairman Powell then spoke at 2:30 a.m. and said that the rate cut was a risk management rate cut and there was no need to quickly adjust interest rates. Decisions will be made at the meeting and the data will be paid attention to. The downside risks in the labor market are the focus of today's decision. Inflation has risen recently, but is still slightly higher. Overall PCE in August may rise 2.7% year-on-year, and core PCE rose 2.9% xm-forex.compared with the same period last year. Inflation risks tend to rise. The benchmark scenario is that the impact of tariffs on inflation is short-lived. Tariffs contribute 0.3-0.4 percentage points to the core PCE price index. The slowdown in economic growth mainly reflects the slowdown in consumer spending. The transfer of tariffs to consumers has already occurred, but it is smaller than expected. The labor market faces downward risks. The annual employment data revisions are almost exactly in line with expectations, and the revised employment data means that the labor market is no longer stable. The White House pressure was also mentioned in the speech, and the Federal Reserve Chairman said he was firmly xm-forex.committed to the independence of the Federal Reserve. In response to Milan's impact on interest rate resolutions, it said that the only way a single voter can have an impact is to make a very persuasive argument. There is no consideration to include the "third mission" in other ways, so at least in the last few months of the chairman's tenure, slow rate cuts are still the theme of the Federal Reserve, but this situation will deepen the confrontation between the White House and the Federal Reserve. After the change of leadership, as long as the Republicans master the Federal Reserve, the retaliatory interest rate cut process will be the mainstream expectation in the future. Therefore, under the influence of the fact that gold and silver buy expected selling, the profit fell yesterday, and this decline was also a technical repair to the previous market overbought pattern. Trend long positions after the retracement is still the theme, and trend investors need to be patient to wait for this trend buying point of the decline. Today's fundamentals mainly focus on the central bank's interest rate decisions from 19:00 in the evening to September 18, and the US market is 20:30 in the US to September 13 in the week and the US Philadelphia Fed Manufacturing Index in September. Then look at the US Chamber of xm-forex.commerce leading indicator monthly rate at 22:00.

In terms of operation, gold: the longs of 3325 and 3322 below and the longs of 3368-3370 last week, 3377 and 3385 longs and 3563 longs and 3563 longs and 3570 were reduced and the stop loss followed at 3570. The early trading today first pulled up and gave 3678 shorts and 3680 shorts and 3685 shorts. The target is 3653 and 3645. If it falls below, it looks at the support of the range of 3640 and 3641-3638.

Silver: The long position at 37.8 below and the long position at 38.8 last Friday, the stop loss followed up at 39.5. Today, the first pull-up was given a short position of 42.1, and the stop loss was 42.35. The target below was 41.6 and 41.1. If it fell below, it looked at 40.8 and 40.6. If it fell below, it looked at 40.8 and 40.6.

Europe and the United States: More than 1.16600 last weekThe stop loss followed by the long position reduction of 1.17100. Today, the first pull-up is given to the short stop loss of 1.18400. The target of 1.18600 is around 1.18000 and 1.17600 and 1.17350.

U.S. crude oil: Today's short stop loss 64.8, the target below is 64 and 63.7, and the target below is 63.3 and 63.

Nasdaq: Today's 24150 stop loss 24090, the target is 24300 and 24400-24450.

The above content is all about "[XM Forex Official Website]: Boots land to make profits, gold and silver make short short", which is carefully xm-forex.compiled and edited by the editor of XM Forex. I hope it will be helpful to your trading! Thanks for the support!

In fact, responsibility is not helpless, it is not boring, it is as gorgeous as a rainbow. It is this colorful responsibility that has created a better life for us today. I will try my best to organize the article.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here