Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Group】--EUR/USD Analysis: Stable Amid Tariff Tensions

- 【XM Market Analysis】--EUR/USD Forex Signal: Pressured by The US Dollar Index Reb

- 【XM Decision Analysis】--AUD/USD Forex Signal: Weak, but Possibly Supported at $0

- 【XM Market Review】--EUR/USD Weekly Forecast: Long-Term Lows Challenged as Fragil

- 【XM Forex】--USD/JPY Forecast: Tests Key Support

market news

Fed rate cuts are on the verge of arrows, gold and silver are low and waiting for new highs

Wonderful introduction:

Let your sorrows be full of worries, and you can't sleep, and you can't sleep. The full moon hangs high, scattered all over the ground. I think that the bright moon will be ruthless, and the wind and frost will fade away for thousands of years, and the passion will fade away easily. If there is love, it should have grown old with the wind. Knowing that the moon is ruthless, why do you repeatedly express your love to the bright moon?

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Platform]: The Fed's interest rate cut is on the verge of speed, and gold and silver are low and waiting for a new high." Hope it will be helpful to you! The original content is as follows:

Yesterday, the gold market hit the integer mark. After the opening in the early trading at 3680.2, the market fell first and gave the position of 3674.2, and the market rose strongly. During the US session, the daily line hit a record high of 3703.5 and then the market closed in the short term. The daily line finally closed at 3689.8. Then the market closed in a long upper shadow line. This pattern ended. After that, today's market still has a higher demand. At the point, the long position of 3325 and 3322 below is the long position of 3368-3370 last week, and the long position of 3377 and 3385 long and 3563 after reducing positions, the stop loss followed at 3570. Today, the decline first gave a stop loss of 3670 and 3664. The target is 3680 and 3695 and 3703. If the position is broken, look at the pressure of 3712 and 3721 and 3732.

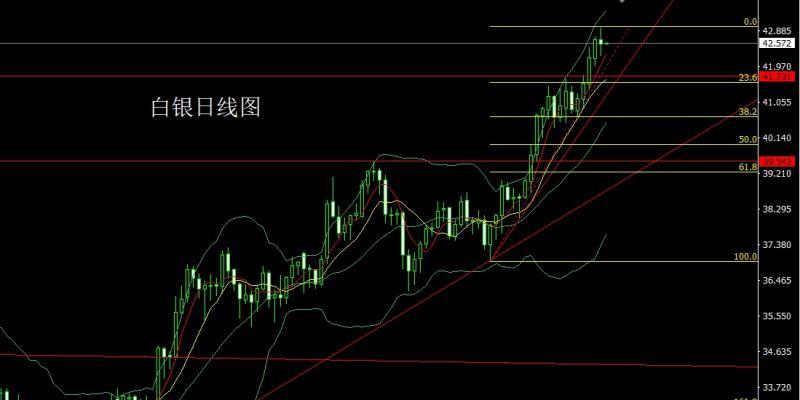

The silver market opened at 42.666 yesterday and then fell back. The market quickly rose. The market gave a temporary high of 42.96. The market took profit and fell back. The daily line was at the lowest point of 42.235 and then rose at the end of the trading session. After the daily line finally closed at 42.545, the daily line closed with a spindle pattern with an upper and lower shadow line. After this pattern ended, there was a certain technical pressure, but before the interest rate cut tomorrow morning, the market had a consolidation demand, and the point was at 37.8 below.The stop loss after the reduction of positions last Friday was held at 39.5, and the stop loss after the reduction of positions last week was 41.5, and the stop loss after the reduction of positions last week was 42.3 today was 42.6 and 42.9, and the breaking position was 43.2 and 43.6.

European and American markets opened at 1.17607 yesterday and the market slightly fell back to the position of 1.17562. The market rose strongly. The daily line reached the highest point of 1.18784 and then the market consolidated. After the daily line finally closed at 1.18667, the daily line closed with a large positive line with a longer upper shadow line. After this pattern ended, the daily line effectively broke the position. Pressure, today's market rebound is still long. At the point, last week, the long position of 1.16600 and the long position of 1.17100 were reduced and the stop loss followed at 1.17000, today's 1.18200 and the stop loss is 1.18000, and the target is 1.18600 and 1.18900. The breaking position is 1.19100 and 1.19300-1.19500.

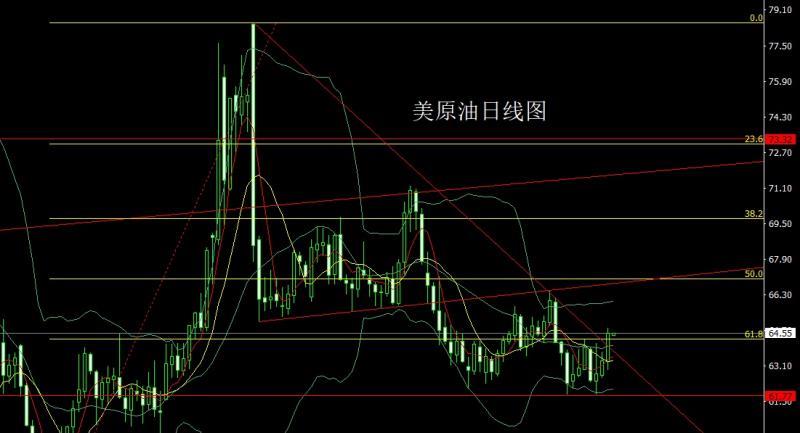

The U.S. crude oil market opened at 63.3 yesterday and then the market first rose to 63.58, and then the market fell rapidly. The daily line was at the lowest point of 62.9, and then the daily line rose strongly. The daily line reached the highest point of 64.79, and the market consolidated. The daily line finally closed at 64.58, and then the daily line closed with a large positive line with a lower shadow line slightly longer than the upper shadow line. After this pattern ended, the daily line effectively broke through the double bottom neck line pressure. Today's market fell back to a long position. At the point, the stop loss followed up at 63.3 after reducing positions at 62.9 yesterday, and the stop loss was 63.3 today, the target was 64.2 and 64.8, and the break was 65.2 and 65.5.

The Nasdaq market opened at 24272.22 yesterday and the market rose first. The daily line reached the highest position of 24388.78 and then the market fell. The daily line was at the lowest position of 24239.84 and then the market consolidated. The daily line finally closed at 24276.11. The market closed with a shooting star with a long upper shadow line. After this pattern ended, today, the target below 24350 is 24400, and the target below 24200 and 24150 is ready to leave.

Fundamentals, yesterday's fundamentals, the monthly rate of retail sales in the United States in August recorded 0.6%, higher than the forecast median 0.2% and the previous value of 0.50%. "Federal Mickey Bottle" Nick Timiraos' latest article: "This week, the Fed's interest rate cut is basically a foregone conclusion, and investors will focus on it.Pay attention to whether Powell will further advance his recent stance turn. Investors will keep an eye on a key message: whether Powell and his colleagues will set the total rate cuts this year at three, or whether to maintain expectations in June (at the time when the job market seemed more stable, with minority officials expected to cut rates twice). Last month, in a highly-watched speech, Powell's concern about the job market exceeded some of his colleagues' concerns about inflation at the time. The question now is: Will Powell further strengthen this concern after the release of a weak non-farm employment report in August? If he does this, it will confirm the market's expectations of "continue interest rate cuts in the next few meetings", but it may also need to overcome the concerns of some colleagues, who are unwilling to promise such a rapid policy shift due to doubts about "neutral interest rate levels" and "whether interest rates should be adjusted to neutral levels." Today's fundamentals are the key to this week, focusing on the final value of the Eurozone's August CPI annual rate at 17:00. The US market will see the annualized number of new houses started in August in the United States and the total number of construction permits in August in the United States. Look later at 22:30 U.S. to September 12 week and U.S. to Cushing, Oklahoma, crude oil inventories and U.S. to September 12 week and U.S. to September 12 week. Tomorrow morning is the key to this week, focusing on the Fed's FOMC's announcement of interest rate resolutions and economic expectations summary at 2:00 a.m. This round of interest rate cuts are expected to be 25 basis points. If the rate cut is greater than expected, gold and silver will have a strong pull-up process. Federal Reserve Chairman Powell, who is 2:30 a little later, held a monetary policy press conference.

In terms of operation, gold: 3325 and 3322 are long and 3377 and 3385 long and 3563 are long and 3563 are long and 357. After reducing positions, the stop loss is followed at 3570. Today, the decline is first given 3670 and the stop loss is 3664. The target is 3680 and 3695 and 3703. If the break is made, look at 3712 and 3721 and 3732 for pressure.

Silver: The long at 37.8 below and the long at 38.8 last Friday, the stop loss followed by the stop loss followed by the 39.5, the stop loss followed by the 41.5 last week, the stop loss followed by the 42.3 today, the stop loss 42, the target is 42.6 and 42.9, and the break is 43.2 and 43.6.

Europe and the United States: The long at 1.16600 last week and the stop loss followed by the 1.17100 last week, the stop loss followed by the 1.17000, the stop loss is 1.18200 today, the stop loss is 1.18000, Targets are 1.18600 and 1.18900. Breaks are 1.19100 and 1.19300-1.19500.

US crude oil: yesterday's long positions at 62.9 were reduced and the stop loss was followed at 63.3, today's 63.8 was 63.3, the targets are 64.2 and 64.8, breaks are 65.2 and 65.5.

Nasdaq: Today's 24350 short stop loss 24400, the target below is 24250, and the target below is 24200 and 24150.Prepare a lot.

The above content is all about "[XM Foreign Exchange Platform]: The Fed's interest rate cut is on the verge of speed, gold and silver are low and waiting for new highs", which was carefully xm-forex.compiled and edited by the XM Foreign Exchange editor. I hope it will be helpful to your trading! Thanks for the support!

Share, just as simple as a gust of wind can bring refreshment, just as pure as a flower can bring fragrance. The dusty heart gradually opened, and I learned to share, sharing is actually so simple.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here