Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Market Analysis】--NZD/USD Analysis: Long-Term Lower Values Seen as Nervousne

- 【XM Forex】--Weekly Forex Forecast – EUR/USD, USD/JPY, NZD/USD, AUD/USD, NASDAQ 1

- 【XM Market Review】--GBP/USD Forex Signal: Eyes Bearish Breakout

- 【XM Market Review】--USD/CAD Forecast: Can the Loonie Hang On?

- 【XM Decision Analysis】--USD/MXN Forecast: Drops Amid Thanksgiving Lull

market news

Non-agricultural fraud economy declines, risk-averse hammer heads are full of gold and silver

Wonderful Introduction:

Youth is the nectar made of the blood of will and the sweat of hard work - the fragrance over time; youth is the rainbow woven with endless hope and immortal yearning - gorgeous and brilliant; youth is a wall built with eternal persistence and tenacity - as solid as a soup.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange]: Non-agricultural counterfeiting economy is in decline, and there is a lot of gold and silver at risk aversion." Hope it will be helpful to you! The original content is as follows:

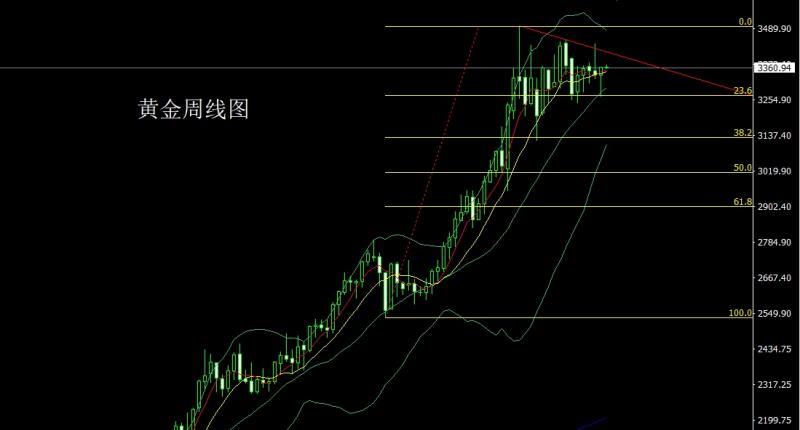

Last week, the gold market opened at the 3337.3 position and the market rose slightly, and then the market fell sharply. The weekly line was at the lowest point of 3267.5. Then it rose strongly on Friday due to the enhanced expectations of poor interest rate cuts in non-agricultural areas. The weekly line finally closed at the 3363.2 position and then closed at the 3363.2 position. After the weekly line closed with a very long hammer head pattern. After such a pattern ended, the weekly line was rubbed at a high level, and after the bottoming out, the weekly line fell back first this week. At the point, the morning retracement today gave 3335 long conservative 3333 long stop loss 3329. The target was 3345 and 3355 and 3367 pressures. If it broke, look at 3372 and 3381 and 3390.

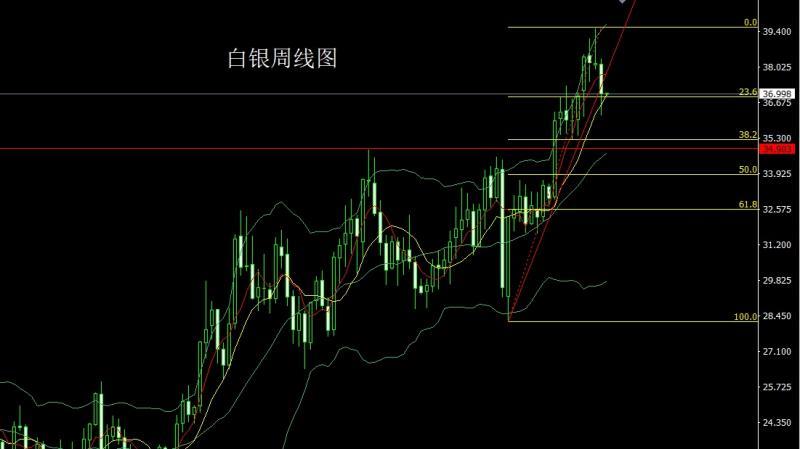

The silver market opened at 38.139 last week and then rose first. The market fell strongly. The weekly line was at the lowest point of 36.181 and then rose at the end of the trading session. After the weekly line finally closed at 37.008, the weekly line closed with a large negative line with a very long lower shadow line. After this pattern ended, the weekly line was 36.6 long stop loss 36.3 this week, and the target was 37 and 37.3 and 37.6.

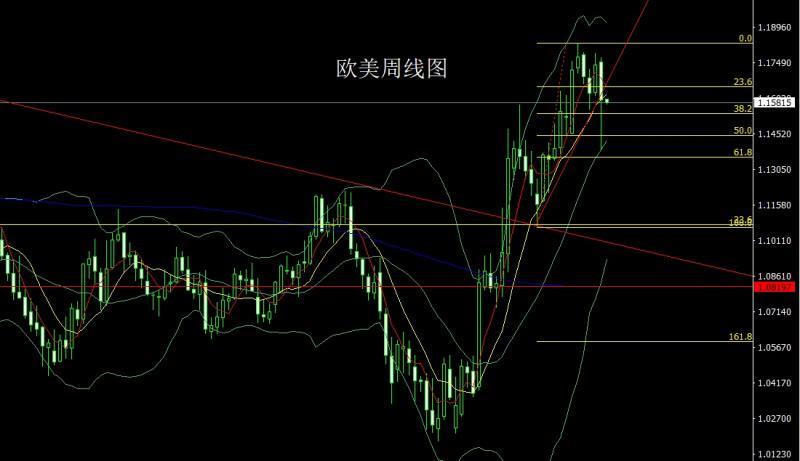

The European and American markets opened at 1.17514 last week and the market rose slightly, giving a position of 1.17719. The market fell strongly. The weekly line was at the lowest point of 1.13880. The market rose strongly at the end of the trading session. After the weekly line finally closed at 1.15945, the weekly line closed with a large negative line with a very long lower shadow line. After this pattern ended, the stop loss of more than 1.15100 this week was 1.14900. The target was 1.015600 and 1.15900 and 1.16200 and 1.16500.

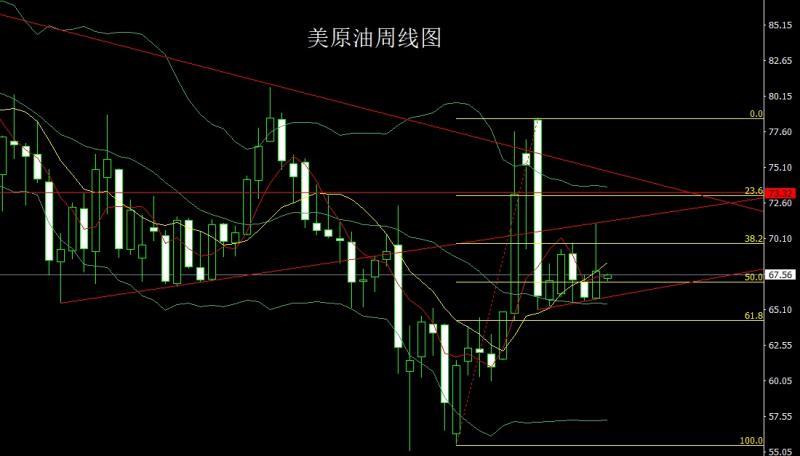

The U.S. crude oil market opened at 65.88 last week and the market fell slightly. After giving a 65.83 position, the market rose strongly. The weekly line reached the highest point of the previous trend line pressure of 71.2, and the market fell strongly. The weekly line finally closed at 67.8. After the market closed in a very long upper shadow line, the market closed in a form of inverted hammer head. After this pattern ended, 68.6 short stop loss was 69.1 today, and the target below was 67 and 66.5 and 66.

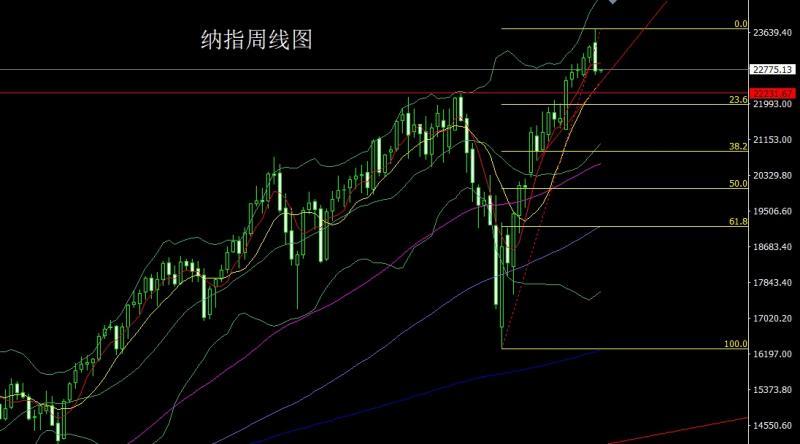

The Nasdaq market opened higher at 23390.5 last week and then fell slightly backwards, giving the position of 23214.15 and then rose strongly. The weekly line reached the highest position of 23709.6 and then fell under pressure. After the market accelerated downward after Friday's non-agricultural market, the weekly line was at the lowest position of 22650.99 and then consolidated. After the weekly line finally closed at 22740.1, the weekly line was up with one The big negative line with a long shadow line closed, and after this pattern ended, the short stop loss of 23010 this week was 22950, and the target below was 22700 and 22650, and the target below was 22600 and 22500 and 22450.

The fundamentals, important data last week were frequently released. The Federal Reserve kept interest rates unchanged for the fifth consecutive time at its July meeting, keeping the target range of the federal funds rate between 4.25% and 4.5%. The Fed's policy statement said that although inflation has fallen from a high level, it is still above the target level of 2%, the employment market remains stable, while economic growth slowed down in the first half of the year, and uncertainty remains prominent. The Federal Reserve emphasized that its goal is to achieve maximum employment and a long-term inflation rate of 2%, and future interest rate adjustments will depend on the latest economic data, outlook changes and risk balance. It is particularly noteworthy that at this meeting, directors Waller and Bowman voted to immediately cut interest rates by 25 basis points, breaking the tradition of "zero votes" for more than 30 years. Data released on Friday night showed that the U.S. non-farm population recorded 73,000 in July, the smallest increase since October last year. The unemployment rate recorded 4.2%, rebounding from the previous month. The corrections in May and June are much larger than usual, with a total of 258,000 people down. After the data was released, traders xm-forex.completely digested the situation of the two rate cuts by the end of the year.Traders believe the probability of the Fed cutting interest rates by 25 basis points in September is 75%, xm-forex.compared with 45% before the non-farm report was released. After the data, the gold and U.S. index markets rose, and this week's fundamentals focused on the monthly rate of U.S. factory orders at 22:00 on Monday. On Tuesday, we focused on the US June trade account at 20:30, and then looked at the final value of the US July S&P Global Services PMI at 21:45. Watch the US July ISM non-manufacturing PMI at 22:00 a little later. We focused on the US July global supply chain pressure index at 22:00 on Wednesday, and later on, the EIA crude oil inventories from the US to August 1 week at 22:30 and the EIA crude oil inventories from the US to August 1 week at the week at the EIA Cushing crude oil inventories from the US to August 1 week at the week at the EIA strategic oil reserve inventories from the US to August 1 week at the week at the EIA. On Thursday, the Bank of England announced its interest rate resolution, meeting minutes and monetary policy report at 19:00. Later, look at the number of people who requested unemployment benefits in the United States from 20:30 to August 2, then look at the monthly wholesale sales rate in June at 22:00 and the New York Fed's 1-year inflation expectation in July at 23:00. The Bank of Japan, which is at 7:50 on Friday, released a summary of the opinions of members of the July monetary policy meeting.

In terms of operation, gold: Retracement in the morning today gave 3335 long conservative 3333 long stop loss 3329, targeted at 3345 and 3355 and 3367 pressures, if broken, see 3372 and 3381 and 3390.

Silver: 36.6 long stop loss 36.3 this week, targeted at 37 and 37.3 and 37.6.

Europe and the United States: 1.15100 long stop loss 1.14900, targeted at 1.015600 and 1.15900 and 1.16200 and 1.1 6500.

U.S. crude oil: 69.1 short stop loss today, and the target below is 67 and 66.5 and 66.

Nasdaq: 22950 short stop loss this week, 23010, 22700 and 22650, and the target below is 22600 and 22500 and 22450.

The above content is all about "[XM Foreign Exchange]: Non-agricultural fraud economy declines, safe-haven hammer heads with a lot of gold and silver". It was carefully xm-forex.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

Due to the author's limited ability and time constraints, some content in the article still needs to be discussed and studied in depth. Therefore, in the future, the author will conduct extended research and discussion on the following issues:

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here