Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Fed interest rate resolution is coming, Trump's pressure on Powell's effect is t

- Gold continues to weaken, and there is a short opportunity around 3310!

- A collection of positive and negative news that affects the foreign exchange mar

- New Zealand dollar/USD bears dominate, upward resistance is significant

- Beware of the high-chasing trap

market news

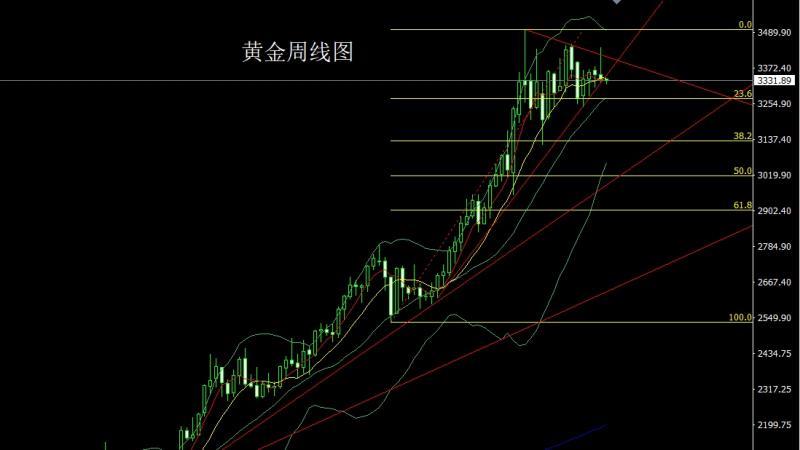

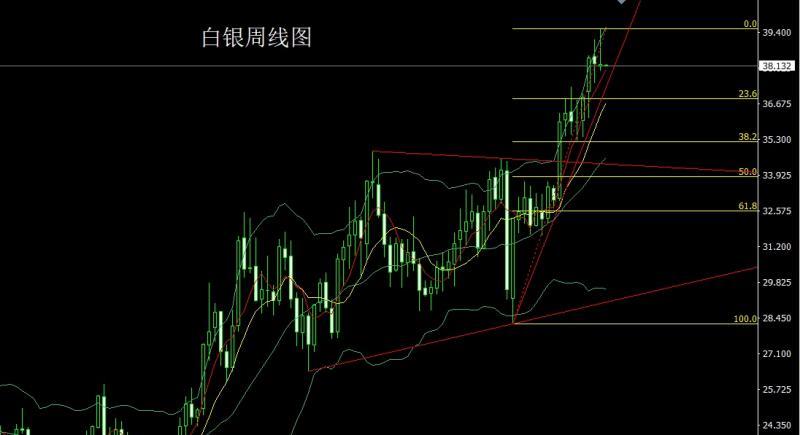

The weekly line is high and the hammer head is high after short gold and silver

Wonderful Introduction:

Only by setting off can you reach your ideals and destinations, only by working hard can you achieve brilliant success, and only by sowing can you gain. Only by pursuing can one taste a dignified person.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Decision Analysis]: Weekly line rises and reverse hammer head, short gold and silver will be high after being long." Hope it will be helpful to you! The original content is as follows:

Last week, the gold market rose and fell due to fundamental influence. At the beginning of the week, the market fell back to the position of 3350.4. After the market opened at the position of 3344.8, the market rose strongly. The weekly line reached the highest position of 3439.2. After the market fell strongly. By the Friday weekly line, it was given the lowest position of 3324.6 and then the market rose at the end of the trading session. The weekly line finally closed at the position of 3336.5. After the market closed with an extremely long inverted hammer head pattern. After this pattern ended, there was a bearish demand on the weekly line, but it hit the bottom directly in the early trading. Today is short and short. At the point, today's 3224 long stop loss 3219, and the target is 3237, 3242 and 3250 pressures leaving the market.

The silver market opened at 38.108 last week and then the market fell slightly. After the market rose sharply, the weekly line reached the highest position of 39.523 and then fell strongly. The weekly line was at the lowest position of 37.923 and then consolidated at the end of the trading session. After the weekly line finally closed at 38.163, the weekly line closed with a shooting star with an extremely long upper shadow line. After this pattern ended, there was a bearish demand this week. At the point, 38.5 short stop loss was 38.7 today, and the target below looked at 38.1 and 37.9 and 37.6.

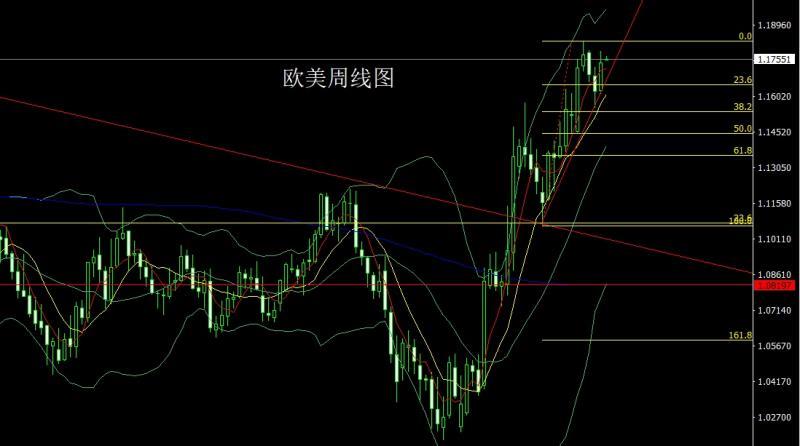

The European and American markets opened at 1.16242 last week and the market fell slightly. The market rose sharply. The weekly line reached the highest point of 1.17893 and then consolidated at a high level. The weekly line finally closed at 1.17482, and the market closed with a large positive line with a long upper shadow line. After this pattern ended, it fell back to 1.17150 and 1.17000 today. The targets were 1.17550 and 1.17650-1.17700.

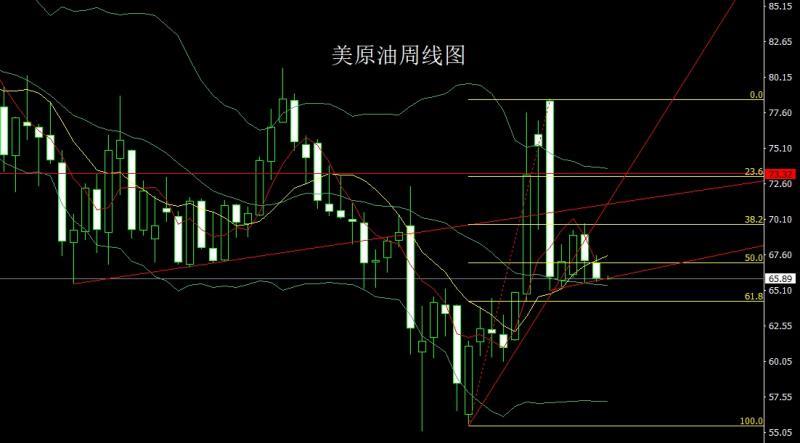

The U.S. crude oil market opened at 67.04 last week and then rose first. The market fell rapidly. The weekly line was at 65.67 and then rose strongly. The weekly line reached the highest point of 67.56 and then fell strongly at the end of the trading day. The weekly line finally closed at 65.92 and then closed with a baroon line with a long upper shadow line. After this pattern ended, the short stop loss of 67.1 this week, the target below was 65.9 and 65.5, and the falling below was 65.2 and 65*64.6.

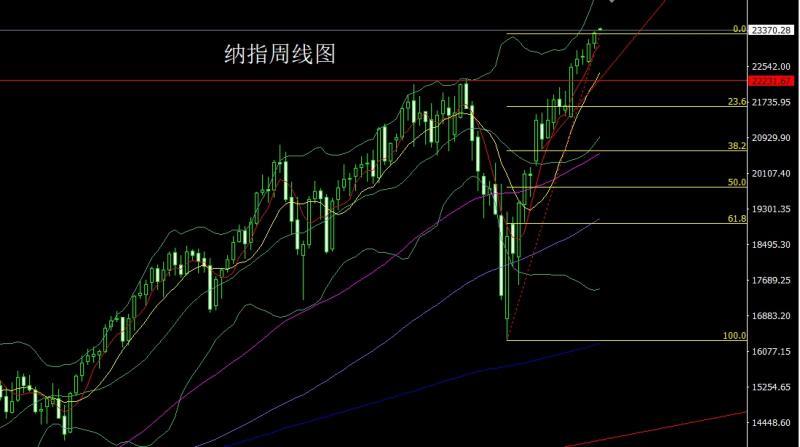

The Nasdaq market opened at 23058.77 last week and then the market first rose. The market fell rapidly. The weekly line was at the lowest point of 22946.92. The market rose strongly. The weekly line reached the highest point of 23330.64. The weekly line closed with a medium-positive line with a lower shadow line longer than the upper shadow line. After this pattern ended, it opened high and fell back to 23300 and stopped loss of 23240. The target was 23400 and 23500-23550.

The fundamentals, last week's fundamentals, the US President rarely visited the Federal Reserve headquarters and confronted Chairman Powell head-on about the cost of the headquarters renovation project. It pointed out that the project budget has soared to $3.1 billion, while Powell refuted that the data is inaccurate, and the two sides have made public differences in the media. The president of a country is so concerned about the renovation of a building. The main purpose of forcing the Federal Reserve Chairman to cut interest rates as soon as possible. In terms of tariffs, Japan xm-forex.compromised last week. The United States will impose a 15% tariff on Japanese goods, while Japan promised to invest $550 billion in the United States. In terms of geopolitical situation, fierce conflicts occurred between Cambodia and Thailand's border areas, and the situation escalated sharply. Thailand said the conflict has killed at least 11 people and injured 28 people. However, in addition to high-level confrontation, the main factors of this conflict are mainly caused by unclear demarcation. There is little chance of conflict expansion. This week's fundamentals are mainly focused on the US Dallas Fed Business Activity Index in July at 22:30 on Monday. On Tuesday, the US May FHFA House Price Index monthly rate and the US May S&P/CS 20 major cities have not adjusted the housing price index in the US seasonallyYearly rate. Then look at the 22:00 US June JOLTs job openings and the US July Consulting Chamber of xm-forex.commerce Consumer Confidence Index. On Wednesday, we focused on the initial annual GDP rate of the euro zone for the second quarter at 17:00. Then look at the number of ADP employment in the United States in July at 20:15. This round is expected to be 75,000, with the previous value of -33,000. Then look at the initial value of the annualized quarterly rate of the US real GDP in the second quarter and the initial value of the US real personal consumption expenditure in the second quarter. Then look at the initial value of the annualized quarterly rate of the US core PCE price index in the second quarter. Then look at the monthly rate of the US June existing home signing sales index at 22:00, and look at the EIA crude oil inventories at 22:30 in the week of July 25 and the EIA crude oil inventories in the week of July 25 in the week of July 25 in the week of EIA Cushing in Oklahoma and the EIA strategic oil reserve inventories in the week of July 25. On Thursday, the Federal Reserve FOMC announced its interest rate decision at 2:00 a.m. and Fed Chairman Powell held a monetary policy press conference at 2:30. This round of expected interest rate cuts will not be expected, but under repeated pressure from the US president, it is worth paying attention to whether the Fed's attitude can change. In the evening, we will see the number of initial unemployment claims in the United States to July 26th and the annual rate of the core PCE price index in June. Watch the Chicago PMI in July at 21:45 in the United States. On Friday, we will pay attention to the initial annualized value of the CPI in the euro zone in July at 17:00. This round is expected to be 1.9%, and the previous value is 2%. In the evening, we look at the unemployment rate in the United States in July at 20:30 and the non-farm employment population after the seasonal adjustment in July. This round is expected to be 4.2% and 102,000. Then look at the final value of the S&P Global Manufacturing PMI in July at 21:45, then look at the final value of the US July ISM Manufacturing PMI in July at 22:00, the final value of the University of Michigan Consumer Confidence Index in July and the expected final value of the US July one-year inflation rate and the monthly rate of construction expenditure in June.

In terms of operation, gold: 3224 long stop loss 3219 today, target 3237, 3242 and 3250 pressures to leave the market and prepare to be short.

Silver: 38.5 short stop loss today 38.7, the target below is 38.1 and 37.9 and 37.6.

Europe and the United States: This week, the stop loss of 1.17150 is first fallen by 1.17000, the target is 1.17550 and 1.17650-1.17700.

US crude oil: 66.6 short stop loss this week 67.1, the target below is 65.9 and 65.5 , if the price falls below 65.2 and 65*64.6.

Nasdaq Index: Today, it opened high and fell back to 23300 and 23240. The target is 23400 and 23500-23550.

The above content is all about "[XM Foreign Exchange Decision Analysis]: Weekly line rises and reverse hammer heads, gold and silver short long and high altitude" is carefully xm-forex.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

Every successful person has a beginning. Only by having the courage to start can you find the way to success. Read the next article now!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here