Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Decision Analysis】--EUR/JPY Forecast: Euro Rallies Against the Yen

- 【XM Forex】--FTSE Forecast: Consolidates, Eyes Breakout Above 8600

- 【XM Decision Analysis】--USD/MYR Analysis: Steadies After Volatility

- 【XM Forex】--BTC/USD Forecast : Bitcoin Rallies Again as CPI Misses in America

- 【XM Decision Analysis】--USD/JPY Forecast: Rises Amid Interest Rate Divergence

market news

The long and short news frequently switches, and the gold roller coaster gradually fluctuates upward

Wonderful introduction:

Optimism is the line of egrets that are straight up to the blue sky, optimism is the ten thousand white sails beside the sunken boat, optimism is the lush grass that blows with the wind on the head of the parrot island, optimism is the falling red spots that turn into spring mud to protect the flowers.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Platform]: The long and short news frequently switches, and the gold roller coaster gradually fluctuates upward." Hope it will be helpful to you! The original content is as follows:

Zheng's silver point: The long and short news frequently switches, and the gold roller coaster gradually fluctuates upward

Review yesterday's market trend and technical points:

First, in terms of gold: Yesterday, 3350 was used as the key pressure point. Since the daily short-term moving average was dead cross, it would be easy to rise and fall in the day to pull up first; therefore, it repeatedly fell in the short-term bearish decline at 3343 and 3344. , all successfully grasped the 10 US dollars; for those with poor entry, it is also a reminder to adjust the capital position, after all, only a good position can be held; for the US market, the research report was waiting for 3351 to be under pressure again to continue to look at the volatility range. At that time, it was believed that the CPI data was on the rise, because May was a tax increase period, but it still fell, which did not meet market expectations, which was quite unexpected, so the gold price rushed to a wave, but it still did not continue, and the 3361 suppression quickly fell back to 3350. Next, I remind you to wash the market carefully, and finally break the intraday low. After reaching 3319, I encountered the warming of the Middle East news, and V pulled up again to break the intraday high. I often had a wide tug-of-war, so I could do less operations and stop when I saw it better;

Second, silver: There was little movement yesterday, and the position was 66-66.6 fluctuated and consolidated;

Third, crude oil: Due to the rising situation in the Middle East, it is easy to sting oil prices. Sharply; technically, it also emphasizes attention to the 66 line. After it breaks through the big positive, it will definitely not be able to test the short-term;

Today's market analysis and interpretation:

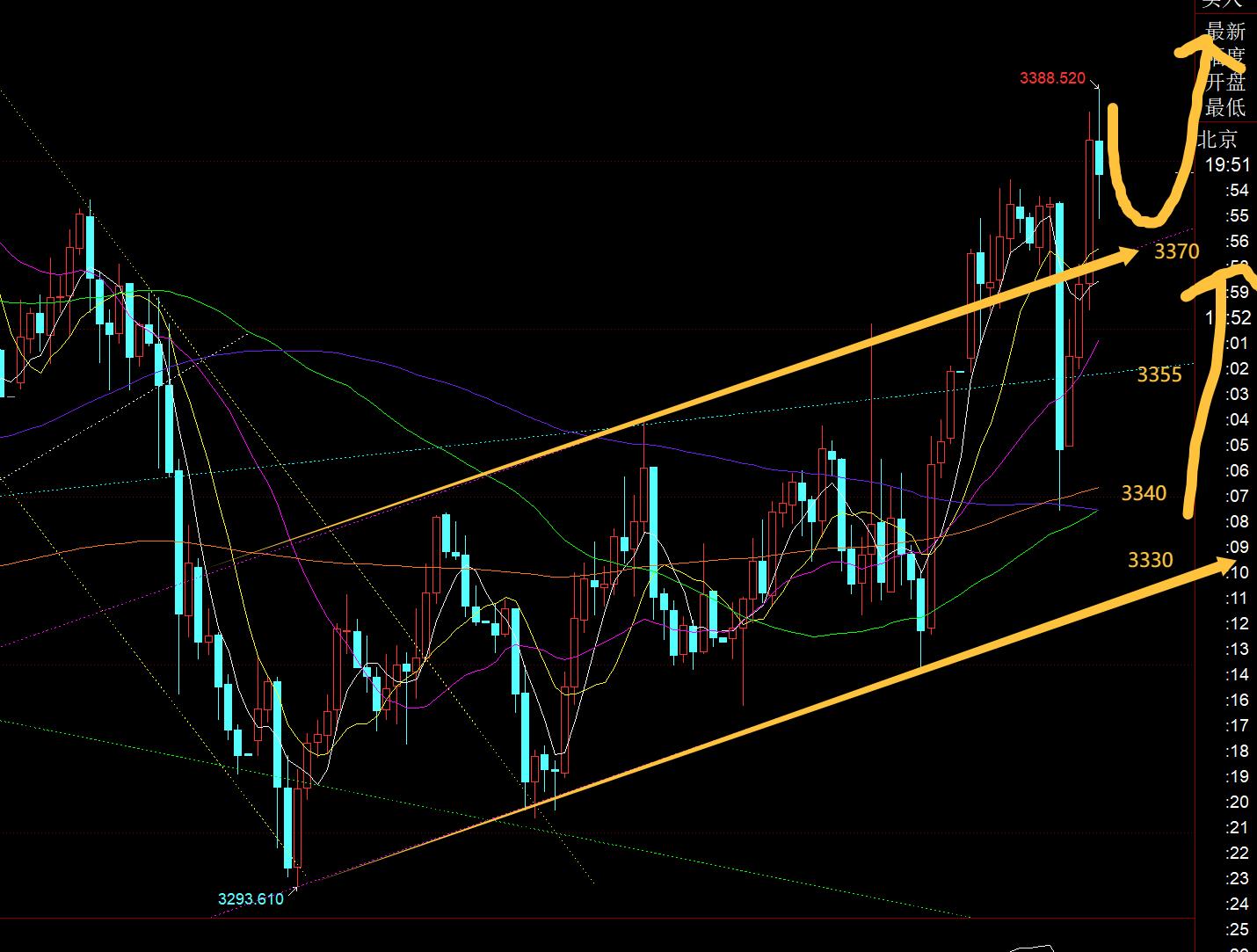

First, gold daily line level: The positive K, which closed yesterday, finally stood on the 5 moving average, so it planned to fall back to the short-term moving average this morning. At that time, it was around 3340 on the 10th and around 3330 on the 5th, touching 3340-3330 is a strong support area, but it can be seen thatLow bullish; a big negative instantly plunged to 3340 in the European session. At the first time, I didn't dare to directly intervene in the bullish 3340, and I stopped at the second position of 3330 to be conservative and bullish. In this way, the defense is close, which is the overnight low point, and I dare to test it. However, after the big negative K, I did not give a chance to consolidate and retrace, and I directly went back to the positive V in one breath; then the daily line level may gradually rise based on the short-term moving average, that is, the trend support line of 3500-3438 is still maintained. The bottom position mentioned in the weekly video is likely to be missed, so I have to proceed in advance;

Second, gold 4-hour level: the big positive position in the middle of the night stands firmly, and the moving average is bullish at this time, and this cycle returns to the bullish situation;

Third, the golden hourly level: overnight V bottomed out and rose, and continued to rise this morning, and kept hovering around 3378-3365 in the afternoon. The European market's big negative dive, giving it a low of 3338, piercing the 618 division position 3342; and the plan is to conservatively wait for the lower track of the channel 3330 up and down to try to stabilize and bullish, and defending the overnight low is more reasonable; the result is a continuous positive reverse, swallowing the big negative and washing back, approaching the next resistance of 3391; then since the European market has strongly broken the high, there will be a second pull-up tonight, but So these days are oscillating, and it is not suitable to directly chase the rise. Retrace back to the upper track of the channel 3370 to confirm stability and follow, and the resistance target is 3391 and 3403. The strong pressure of 3413 may also cause a surge and fall. If the downward trend is broken again, then there will be repeated washing. At that time, the three stabilization signals of 3355, 3340 and 3330 will be lowered, and then we will look bullish. Since the daily level is confirmed to gradually fluctuate and develop upward, for the day, if there is a wash-up squat pulling down, you should try to be bullish at a low level;

Silver: At present, it is still consolidation within the downward channel. Only after effectively breaking through the upper track can you make up for the rise again; or wait until it goes back to the lower track tonight and find a position above 35.7 to stabilize and try to be bullish. It cannot break the new day low again, otherwise it will continue to lower; the daily line has basically reached the level near the 10 moving average, and the next step is to keep the 10 moving average and continue to be bullish;

Crude oil: Yesterday, Dayang stood on the 66 line, and today's retracement confirmed that it can stabilize, you can follow the rebound and pay attention to 66-69 in the next operating range;

The above are several points of the author's technical analysis. As a reference, it is also a summary of the technical experience accumulated by the market watching and reviewing for more than 12 hours a day in the past twelve years. Technical points will be disclosed every day, and text and video interpretations will be interpreted.Friends who want to learn can xm-forex.compare and refer to the actual trends; those who recognize ideas can refer to the operation, lead the defense well, risk control first; those who do not agree should just be over; thank everyone for their support and attention;

[The article views are for reference only. Investment is risky. You must be cautious when entering the market, operate rationally, set losses strictly, control positions, risk control first, and bear the profit and loss at your own risk]

Contributor: Zheng's Dianyin

A study on the market for more than 12 hours a day, persist for ten years, and detailed technical interpretations are made public on the entire network, serving the whole network with sincerity, sincerity, perseverance and wholeheartedness! xm-forex.comments written on major financial websites! Proficient in the K-line rules, channel rules, time rules, moving average rules, segmentation rules, and top and bottom rules; student cooperation registration hotline - WeChat: zdf289984986

The above content is all about "[XM Foreign Exchange Platform]: Frequent switching of long and short messages, and the gold roller coaster gradually fluctuates upward". It is carefully xm-forex.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

In fact, responsibility is not helpless, it is not boring, it is as gorgeous as a rainbow. It is this colorful responsibility that has created a better life for us today. I will try my best to organize the article.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here