Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Market Review】--Nasdaq Forex Signal: Plunges After Better Jobs Figures

- 【XM Group】--Gold Analysis: Steadies Amid Volatility

- 【XM Decision Analysis】--BTC/USD Forecast: Tests Support Amid Market Uncertainty

- 【XM Market Review】--USD/CAD Forecast: Near Highs

- 【XM Group】--USD/ZAR Analysis: Holiday Nervousness and Some Near-Term Indications

market analysis

Gold volatility repairs, pay attention to 3336 first-line short-term suppression tonight

Wonderful introduction:

Optimism is the line of egrets that are straight up to the blue sky, optimism is the ten thousand white sails beside the sunken boat, optimism is the lush grass that blows with the wind on the head of the parrot island, optimism is the falling red spots that turn into spring mud to protect the flowers.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Official Website]: Gold oscillation repair, pay attention to 3336 first-line short-term suppression tonight". Hope it will be helpful to you! The original content is as follows:

Zheng's silver point: Gold fluctuation repair, pay attention to the short-term suppression of 3336 tonight

Review the market trend and technical points that appeared last Friday:

First, gold: Last Friday night, the lower track of the planned channel was 3343 and saw a bottoming up, and it was believed that the non-agricultural employment data would not be very good. The result was announced slightly greater than expected, smaller than the previous value, which was considered a small profit, and the gold price was It was indeed hitting 3343 for the first time and reached nearly US$20; however, the Federal Reserve revised the data and interpreted that the employment data performed well this time, and cooled down the interest rate cut. The gold price fell again in the second half of the night. The second test of 3343 falling, breaking the previous low point of 3333 means that it will weaken and adjust for a short-term downward adjustment;

Second, in terms of silver: its trend has been separated from gold, and these days are in the stage of making up for the rise, and it continues. Just keep bullish;

Interpretation of today's market analysis:

First, gold weekly level: the medium-term upward channel performs well, the lower track support has moved up by 3250 line, and the 10 moving average support has moved upward by 3292 line; as long as the closing still stabilizes the lower track 3250 line, we will continue to be optimistic about the final trend of the medium-term. At present, it is still in the yin and yang cycle, and there is no room for the position away from the lower track. It is expected that the sudden situation will be in the next one or two weeks. Break the market;

Second, gold daily line level: Last Friday, it closed at a big negative, effectively losing the 5 moving average, and there may be a risk of downward adjustment in the short term; however, at the beginning of this week, we should pay attention to the gains and losses of the trend line 3500-3438. Today, the trend line retracement confirmation point moves downward near 3300, which is also close to the middle track position, the 5 moving average moves downward by 3343, and the 10 moving average moves downward by 3328; if it is impossible to stand above the 5 moving average again, thenThere is still room for downward adjustment; once the trend line of 3500-3438 or the middle track is lost, it may point above the trend support line of 2956-3120, corresponding to the limit adjustment position 3228, which is exactly the 618 division point of 3120-3403, try the best point of the band bottoming; of course, it may also keep the trend line of 3500-3438 and not break down, and then go upward after sideways; and the final destination of these two situations is to go above 3500, corresponding to the wave selection, weekly video has also interpreted that there are two ways to move, take one step at a time;

Third, gold hourly line level: This morning, the weak continued to fall last Friday night, piercing the 3306 trend support line, stabilized in the afternoon 3293 and continued to rise, breaking through the 3320 high in the morning, and the pressure on the European session was 3328 fell. Overall, gold still swept and consolidated in the short term, and its continuity was not very good; according to the European session breaking through the Asian session high, the US session still has room for correction of the rebound. Pay attention to 3336-3333, on the one hand, the top and bottom, and on the other hand, the early morning high and annual moving average, which is also up. The pressure point of the upper rail of the downward channel of the figure; once it is suppressed below 3336, it will still remain fluctuating and lowered, and then break through 3293, which means it will point to 3280-3270; of course, if the US market first retraces 3293-3328 in the wave of 618 split support 3307, stabilize, you can try a second oscillation rebound, and then suppress 3336 to fall back; if it unexpectedly breaks through 3336, or even 3343 continues to surge, then 3293 has a probability of becoming a short-term bottom, and subsequent retracement is to grab the second low-point band to pull up;

Silver: it still makes up for the rise and continues to be bullish; when the European session breaks through the small-scale convergence upper triangle today, it also decisively reminds that 36.1 can follow the bullish, the short-term upper channel is about 36.6, and the daily channel resistance is 38-39, and the monthly line division resistance is 40-42. These are all things that need to be considered to be tested step by step in the future; of course, when it is pulling up and going up, you must also be careful of short-term diving corrections, but it has been replaced by long-term sideways or convergence consolidation in the past few days, which is relatively strong; tonight, it remains bullish above 36.1;

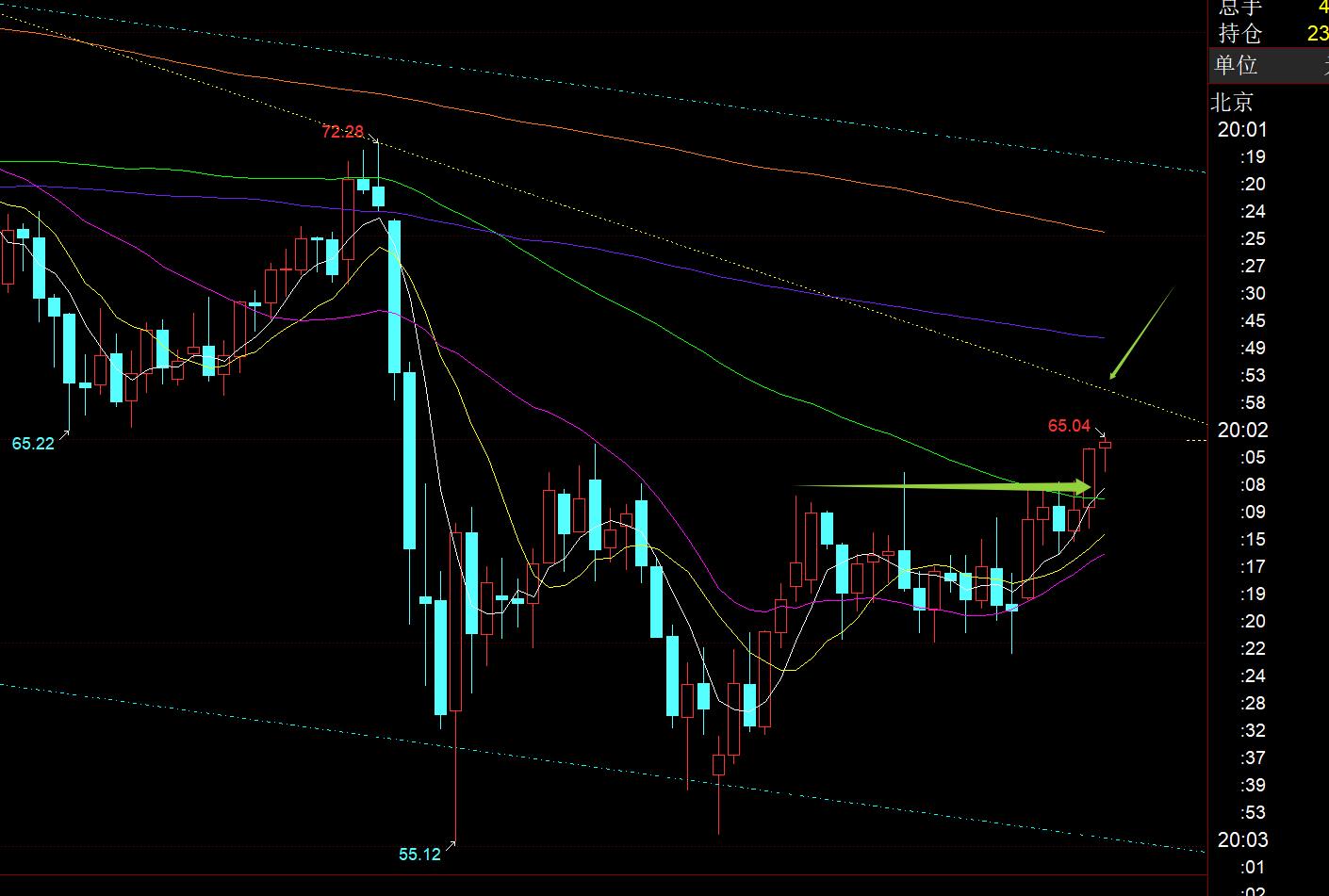

Crude oil: From the daily level of the above chart, the trend resistance is 66-66.2, and the previous oscillation pressure has exceeded 64-63.8 and becomes the top and bottom support. Today, we pay attention to the operation within the range of 63.8-66.2;

The above are several views of the author's technical analysis, as a reference, and it is also 1 day for twelve years.The technical experience accumulated by watching and reviewing the market for more than 2 hours will be disclosed every day. For text and video interpretation, friends who want to learn can xm-forex.compare and refer to it based on the actual trend; those who recognize ideas can refer to it, lead the defense well, and risk control first; those who do not agree should just be drifted by; thank everyone for their support and attention;

[The article views are for reference only. Investment is risky. You must be cautious, rationally operate, strictly set losses, control positions, risk control first, and bear the profit and loss at your own risk]

Contributor: Zheng's Dianyin

After reading and research for more than 12 hours a day, persisting for ten years, detailed technical interpretation is disclosed on the entire network, and serve the whole network with sincerity, sincerity, perseverance and wholeheartedness! xm-forex.comments written on major financial websites! Proficient in the K-line rules, channel rules, time rules, moving average rules, segmentation rules, and top and bottom rules; student cooperation registration hotline - WeChat: zdf289984986

The above content is all about "[XM Foreign Exchange Official Website]: Gold Oscillation Repair, pay attention to 3336 first-line short-term suppression tonight". It was carefully xm-forex.compiled and edited by the XM Foreign Exchange editor. I hope it will be helpful to your trading! Thanks for the support!

In fact, responsibility is not helpless, it is not boring, it is as gorgeous as a rainbow. It is this colorful responsibility that has created a better life for us today. I will try my best to organize the article.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here