Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

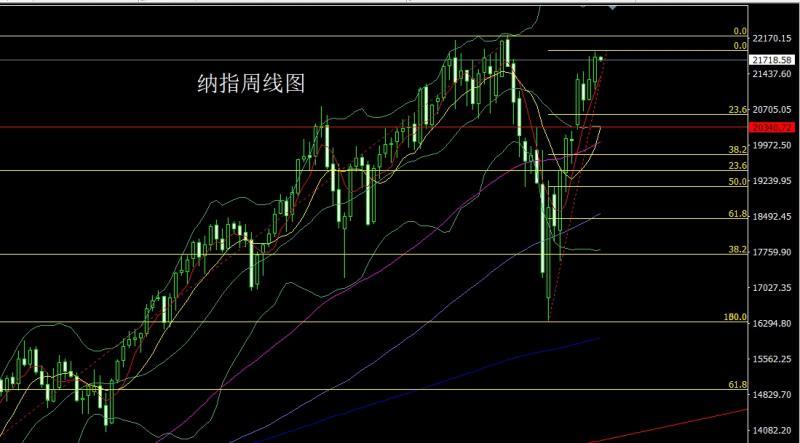

- 【XM Market Analysis】--NASDAQ 100 Forecast: Continues to Look at Ceiling Above

- 【XM Group】--USD/MXN Analysis: Trump Thunderbolt Causes Surge Amidst New Reality

- 【XM Decision Analysis】--USD/MYR Analysis: Near Highs Amid Pre-Fed Caution

- 【XM Group】--USD/MXN Forecast: Fighting Back

- 【XM Market Analysis】--NASDAQ 100 Forecast: Continues to Power Higher

market analysis

The weekly line is under pressure, and gold and silver are short at the beginning of the week

Wonderful introduction:

Don't learn to be sad in the years of youth, what xm-forex.comes and goes cannot withstand the passing time. What I promise you may not be the end of the world. Do you remember that the ice blue that has not been asleep in the night is like the romance swallowed by purple jasmine, but the road is far away and people have not returned, where can the love be lost?

Hello everyone, today XM Foreign Exchange will bring you "[XM Official Website]: The weekly line is under pressure, and the gold and silver weekly delays shortages." Hope it will be helpful to you! The original content is as follows:

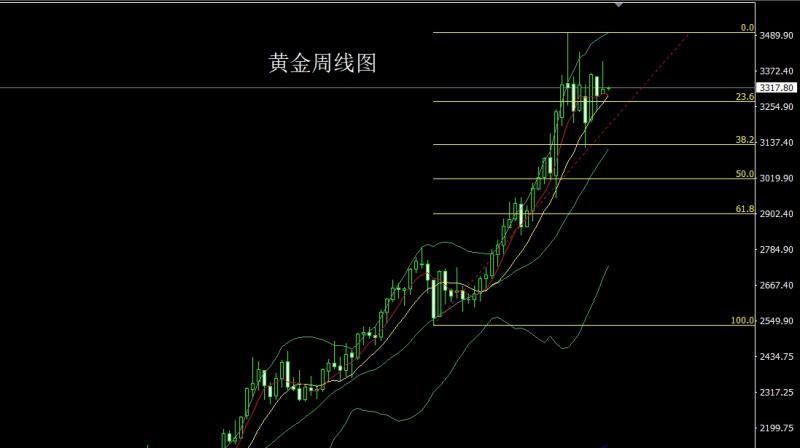

Last week, the gold market opened at 3298.5 and then rose directly. The weekly line reached the highest point of daily pressure at 3404 and then fell strongly at the end of the market. The weekly line finally closed at 3312, and the weekly line closed with a shooting star with a very long upper shadow line. After this pattern ended, the market continued to be short. At the point, the short position of 3373 and 3375 last Friday, and the stop loss followed at 3362. Today's market 3342 short conservative 3345 short stop loss 3349 below the target 3312 and 3307, and below 3300 and 3292 and 3285.

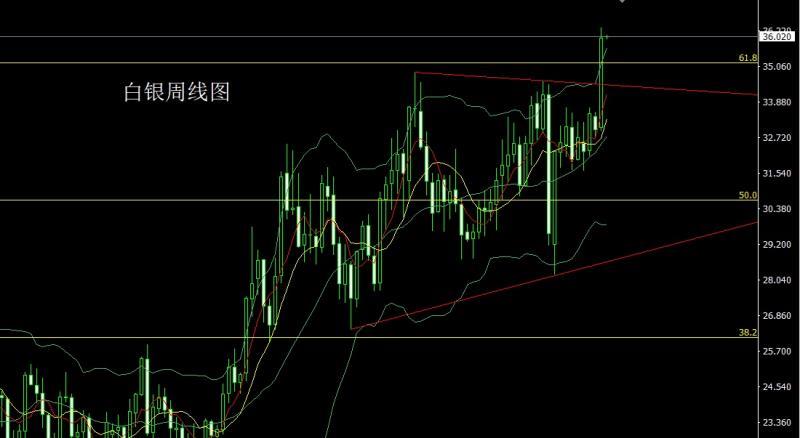

The silver market opened at 33.042 last week and then the market fell first to give a position of 32.919. Then the market rose strongly. By the Friday weekly line reached the highest position of 36.34, the market consolidated. The weekly line finally closed at 35.98 and then the market closed with a large positive line with an upper shadow line longer than the lower shadow line. After this pattern ended, today 36.3 tried to short stop loss 36.5 and 35.5935.3.

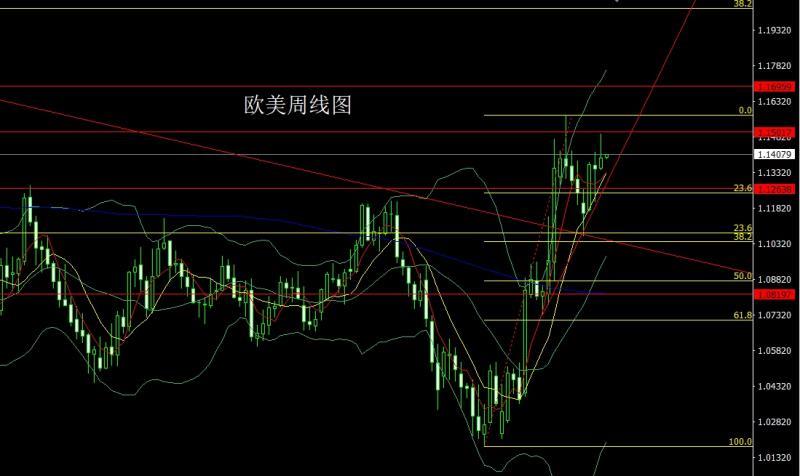

The European and American markets opened at 1.13482 last week and then the market fell first to give a weekly line of 1.13401.After the low point, the market rose strongly. The weekly line reached the highest point of 1.14958 and then the market fell at the end of the trading session. The weekly line finally closed at the position of 1.13927 and the market was the same as the inverted hammer head pattern with a long upper shadow line. After the pattern of this line ended, today, the short stop loss of 1.14350 is 1.14550. The target below is 1.13900 and 1.13700 and 1.13500-1.13350.

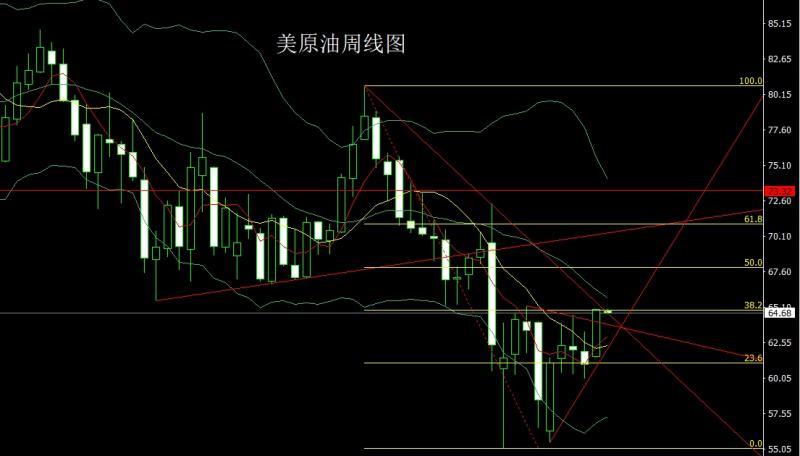

The US crude oil market opened higher at 61.6 last week and then the market fell slightly back to 61.54, and then the market rose strongly. The weekly line reached the highest position of 64.93, and the market consolidated. The weekly line finally closed at 64.92, and then the market closed with a saturated large positive line with a slightly shadow line. After this pattern ended, it fell first today and gave a 64.2 long stop loss of 63.7, with the targets of 64.9 and 65.3 and 65.7.

The Nasdaq market opened at 21266.55 last week and the market fell first, giving the position of 21110.83, and then the market fluctuated strongly. The weekly line reached the highest position of 21895.47 and then the market consolidated. The weekly line finally closed at 21777.42, and the market closed with a large positive line with a lower shadow line slightly longer than the upper shadow line. After this pattern ended, the stop loss of more than 21600 today was 21500. If the target was 21750 and 21850-21900, it would hit the previous historical high this week.

Brands, fundamentals last week The U.S. president once again put pressure on the Fed on social media, urging it to cut interest rates by 100 basis points. He called Federal Reserve Chairman Powell "Mr. Too Chi", accusing him of maintaining high interest rates causing losses to the U.S. national wealth, pushing up the federal government's borrowing costs. He also said that the result of the appointment of the next Federal Reserve Chairman will be announced soon, and he already has a pretty clear understanding of the candidate. He added that a good Fed chairman would lower interest rates. Federal Reserve Chairman Powell recently said that he needs to have a deeper understanding of the impact of other countries' policies on the US economy and financial markets, especially the potential impact of violent US dollar fluctuations on American households and businesses. The latest Fed report pointed out that U.S. economic activity has slowed down in the past six weeks, and hiring has slowed down, and consumers and businesses are worried about the price increase caused by tariffs. The number of non-farm employment in the United States increased by 139,000 in May, higher than expected, and the unemployment rate remained at 4.2%. Financial markets expect the Fed to weaken its interest rate cut in September, and institutional analysts believe employment data supports the Fed to maintain interest rates until the fourth quarter. Musk accused the US president of being ungrateful, saying that without his support, Trump could not win the election, and the seats in the Senate and House of Representatives would be detrimental to the Republican Party. Musk also hinted that the US president refuses to publicly and lovePrstein's documents were involved because he himself was involved and called for the impeachment of the US president. Another major event is that after Ukraine attacked Russia, the second round of negotiations between Russia and Ukraine was held in Istanbul on June 3, and it ended in a hurry in just one hour. No substantial results were achieved except for the exchange of prisoners of war and the return of the bodies of the dead soldiers. Under risk aversion, the gold and silver market fluctuated violently. This week's fundamentals mainly focus on China's May CPI annual rate at 9:30 on Monday, and look at the US' April wholesale sales monthly rate at 22:00 and the US' May New York Fed's 1-year inflation expectation at 23:00 in the evening. On Tuesday, we focused on the UK's May unemployment rate at 14:00 and the euro zone June Sentix Investor Confidence Index at 16:30. On Wednesday, we paid attention to the US's unseasonal CPI annual rate at 20:30, with an expected 2.5% in this round and a previous value of 2.3%. At night, we will see EIA crude oil inventories from the U.S. to June 6 week and EIA Cushing crude oil inventories from the U.S. to June 6 week and EIA strategic oil reserve inventories from the U.S. to June 6 week. On Thursday, we focused on the number of initial unemployment claims in the United States from 20:30 to the week from June 7. On Friday, the Federal Reserve announced the "U.S. Quarterly Financial Account Report". At night, we look at the initial value of the expected one-year inflation rate in the United States in June at 22:00 and the initial value of the University of Michigan Consumer Confidence Index in June.

In terms of operation, gold: last Friday, the short position of 3373 and 3375, the stop loss followed by 3362. Today's market 3342, the short position is conservative, 3345, the short position is 3312 and 3307, and the bottom position is 3300 and 3292 and 3285.

Silver: Today's 36.3 try short stop loss 36.5, the bottom position is 35.7 and 35.5935.3.

Europe and the United States: Today's 1.1435 0 short stop loss 1.14550, the target below is 1.13900 and 1.13700 and 1.13500-1.13350.

U.S. crude oil: The first fallback today gave 64.2 long stop loss 63.7, the target was 64.9 and 65.3 and 65.7.

Nasdaq: The target was 21,600 and 21,500-2,500. If the target was 21,600 and 21,850-21,900, the target would hit the previous historical high this week.

The above content is all about "[XM official website]: The weekly line is under pressure, and gold and silver are short at the beginning of the week". It is carefully xm-forex.compiled and edited by the editor of XM Forex. I hope it will be helpful to your trading! Thanks for the support!

Due to the author's limited ability and time constraints, some content in the article still needs to be discussed and studied in depth. Therefore, in the future, the author will conduct extended research and discussion on the following issues:

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here