Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Group】--GBP/USD Weekly Forecast: Gains as Behavioral Sentiment Does Show Imp

- 【XM Group】--EUR/USD Forecast: Continues its Collapse

- 【XM Market Review】--USD/CHF Forecast: Holds Strong Above 0.90

- 【XM Forex】--CAC Forecast: Continues to Consolidate Overall

- 【XM Decision Analysis】--BTC/USD Forex Signal: Double-Top Chart Pattern Forms

market analysis

Big non-farm hits in April, PCE data will be released, Bank of Japan's resolution this week

Wonderful Introduction:

Green life is full of hope, beautiful fantasy, hope for the future, and the ideal of longing is the green of life. The road we are going tomorrow is green, just like the grass on the wilderness, releasing the vitality of life.

Hello everyone, today XM Foreign Exchange will bring you "[XM Official Website]: April's big non-farm hits, PCE data will be released, and the Bank of Japan's resolution this week." Hope it will be helpful to you! The original content is as follows:

XM foreign exchange market: April's non-farm market is xm-forex.coming, PCE data will be released, Bank of Japan's central bank's resolution this week

XM foreign exchange market: The importance of economic data to be released this week is from high to low: US April non-farm employment report, Bank of Japan's interest rate resolution, and US March core PCE annual rate. Next, we will interpret it one by one.

▲XM chart

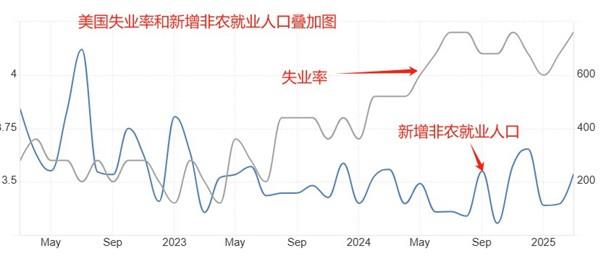

This Friday at 20:30, the U.S. Department of Labor Statistics Bureau will release the April non-agricultural employment report. Among them, the non-agricultural employment population data after the seasonal adjustment in April attracted the most attention, with the previous value of 228,000 people and the expected value of 135,000 people, with a large decline. Small non-agricultural ADP data will be released on Wednesday, with the previous value of 155,000 people and the expected value of 108,000 people, with a large decline. Small non-agricultural products are reliable forward-looking indicators for big non-agricultural products. When the announced value of small non-agricultural products is lower than the previous value, it means that the large non-agricultural products on Friday will also undergo changes in the same direction. As Trump announced a foreign policy that shocked the market in April, business owners and consumer confidence suffered a significant impact, global risk aversion increased, and the labor market performed poorly in April within expectations. In the past three years, the number of new non-agricultural employment has been in a state of fluctuation, with an upper limit of 323,000 and a lower limit of 44,000. In February, 228,000 people were at the upper-middle level. Judging from the volatile thinking, the data in March is likely to hit a peak and fall. By superimposing the unemployment rate data and the new non-farm employment population, it can be found that the unemployment rate in the United States is steadily rising while the new non-farm employment population is fluctuating. Although the unemployment rate in March was 4.2%Healthy status, but gradually rising data suggests that there may be problems in the U.S. labor market.

▲XM chart

This Thursday at 11:00, the Bank of Japan will announce the results of the May interest rate resolution, and the mainstream expects the Bank of Japan to maintain a policy interest rate of 0.5%. It should be noted that the time when the Bank of Japan announces the results of the resolution may be delayed by several hours, and the time of 11:00 is only a reference. At 14:30 on the same day, Bank of Japan Governor Kazuo Ueda will hold a monetary policy press conference to focus on his evaluation of Trump's policies, interest rate paths, inflation and unemployment rates. The US's radical policies may cause damage to Japan's export industry, because Japan's total exports to the US account for as much as 21%, and it is difficult for Japan-US negotiations to substantially reduce the US's barriers to Japan. The market expects that the Bank of Japan's resolution will remain unchanged at 0.5%, and the main consideration is also the uncertainty of the negotiations between Japan and the United States. We believe that although the Bank of Japan will suspend interest rate hikes, it will not terminate interest rate hikes. Japan's core inflation rate has been above the 3% standard for several consecutive months. The current benchmark interest rate has insufficient effect on inflation restrictions, and long-term monetary policy is likely to be tightened.

▲XM chart

At 22:00 this Wednesday, the US Department of xm-forex.commerce will announce the annual rate of the core PCE price index in March, with the previous value of 2.8%, and the expected value of 2.6%. If it is expected to be implemented, it will be negative for the US dollar index. Since February 2024, the annual rate of core PCE in the United States has been below the 3% standard. For the Fed, stable and low PCE data means that the current interest rate has moderate suppression of xm-forex.commodity demand, and there is no need to change monetary policy in the medium term. However, if the PCE data continues to decline, it means that interest rates are excessively curbing demand and interest rates need to be cut as soon as possible. Although the market expects the annual core PCE rate to drop by 0.2 percentage points in March, it has not changed the medium-term volatility, so the probability of the Federal Reserve maintaining current interest rates is higher. Trump's radical policies may have an impact on future price trends: if the US macroeconomic declines due to radical policies, prices will fall and the Federal Reserve may cut interest rates; if the US import prices rise sharply due to policies, thereby pushing up the xm-forex.comprehensive price level, the Federal Reserve may tighten. It is not yet certain that the final result of Trump's policy is determined, so the Fed will maintain its current monetary policy to wait for the uncertainty in the market to disappear.

XM risk warning, disclaimer, special statement: The market is risky, so be cautious when investing. The above content only represents the analyst's personal views and does not constitute any operational suggestions. Please do not regard this report as the sole reference. At different times, analysts' views may change and updates will not be notified separately.

The above content is about "[XM official website]: April's big non-farm farms are xm-forex.coming, PCE data will be released, and the Bank of Japan's resolution this week" is carefully xm-forex.compiled and edited by the editor of XM Forex. I hope it will be helpful to your transactions! Thanks for the support!

Due to the author's limited ability and time constraints, some content in the article still needs to be discussed and studied in depth. Therefore, in the future, the author will conduct extended research and discussion on the following issues:

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here