Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- 【XM Group】--NZD/USD Forecast: New Zealand Dollar Continues to Reach Higher Again

- 【XM Forex】--USD/TRY Forecast: Rises on Lira Weakness and Inflation Strategy

- 【XM Group】--Dax Forecast: DAX Continues to Find Buyers on Dips in Bullish Run

- 【XM Group】--USD/INR: Relative Stability as More Potential Reactions Lurk

- 【XM Group】--USD/TRY Forecast: Turkish Lira Stabilizes Ahead of Turkey's Interest

market analysis

Profit-taking lightning rods, gold and silver continue to rise

Wonderful Introduction:

Green life is full of hope, beautiful fantasy, hope for the future, and the ideal of longing is the green of life. The road we are going tomorrow is green, just like the grass on the wilderness, releasing the vitality of life.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Market Review]: Profit settlement lightning rod, gold and silver continue to rise high." Hope it will be helpful to you! The original content is as follows:

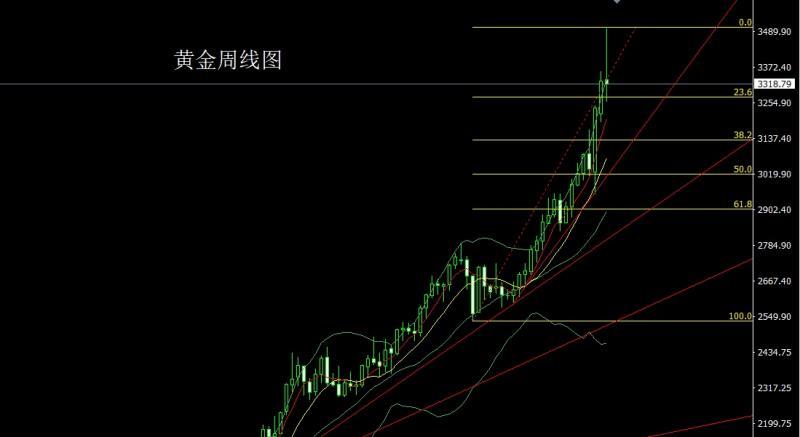

The gold market opened at 3331.5 last week and the market continued the upward trend of the previous week. On Tuesday, the market gave a new historical high of 3500.4, and the market triggered a profit-taking process. The market fell strongly. The weekly line was at the lowest point of 3259 and then the market rose at the end of the trading session. The weekly line finally closed at 3318.8. Then the market used a shooting star with a very long upper shadow line. The pattern closes, and after such a pattern ends, there is a bearish demand for the weekly line. At the point, the short positions of 3496, 3468 and 3442 were reduced last week and the stop loss followed at 3400. After opening high today, the market fell back and gave a 3275 long stop loss of 3269. The target is 3310, 3318, 3324 and 3332 pressures. If the pressure can be broken, look at 3340 and 3345-3350 pressures to leave the market and prepare for weekly short positions.

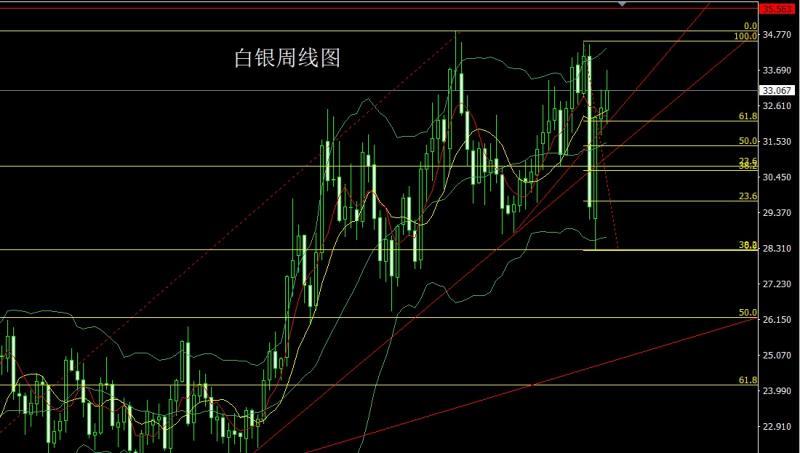

The silver market opened at 32.475 last week and then rose slightly. The market fell. The weekly line was at the lowest point of 32.069 and then rose strongly. The weekly line reached the highest point of 33.688 and then the market consolidated at the end of the trading session. After the weekly line finally closed at 33.067, the weekly line closed with a medium-positive line with a slightly longer upper shadow line than the lower shadow line. After this pattern ended, 33.55 short stop loss was 33.7 today. The target below looked at 32.75 and 32.5 and 32.25 separation.There are many preparations for the field.

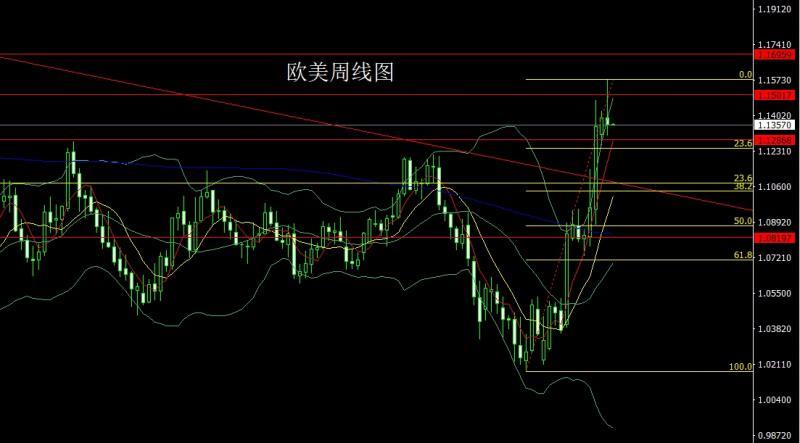

The European and American markets opened at 1.13903 last week and then the market rose directly. The weekly line reached the highest position of 1.15738 and then the market fell strongly. The weekly line finally closed at 1.13039 and then the market closed with an extremely long inverted hammer head pattern. After this pattern ended, it first fell back to 1.12950 today and tried long, stop loss 1.12750, and the target was around 1.13650 and 1.13850 and 1.14100 and 1.14350 to leave the market.

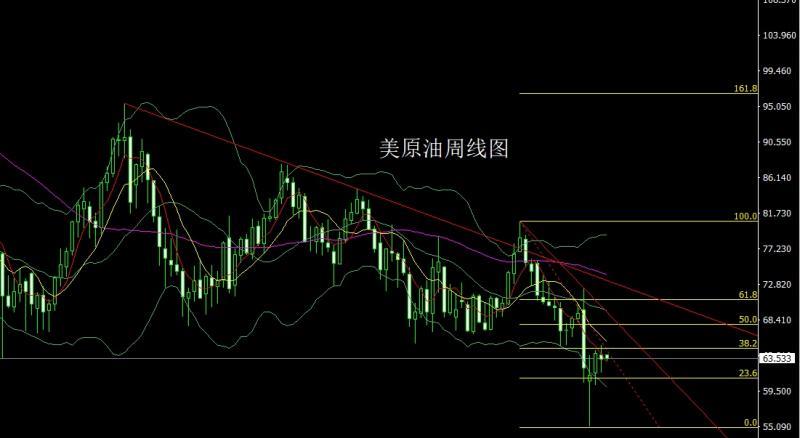

The U.S. crude oil market opened at 64.06 last week and then fell back first. The market rose strongly. The weekly line reached the highest position of 65.18 and then the market fell strongly. The weekly line was at the lowest position of 61.81 and then the market consolidated. The weekly line finally closed at 61.46 and then the market closed in a spindle pattern with a lower shadow line slightly longer than the upper shadow line. After this pattern ended, the stop loss of 62.5 was reduced last Friday and followed at 62.4 after the stop loss of 62.4, today, the target was 63.2 and 64 and 65.2, and the break was 65.6 and 66.

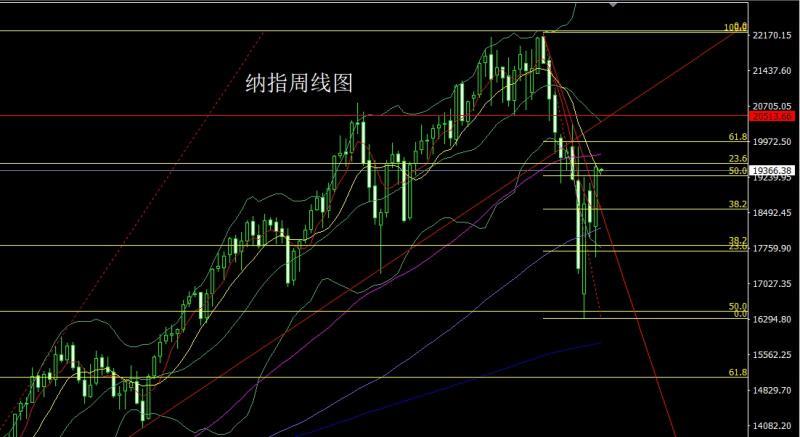

The Nasdaq market opened lower last week at 18219.3 and then the market fell first. The weekly line was at the lowest point of 17565.61 and then the market fluctuated strongly. The weekly line reached the highest point of 19481.58 and then the market consolidated. The weekly line finally closed at 19436.5 and then the market closed with a large positive line with a long lower shadow line. After this pattern ended, today 191 More than 50 stop loss 19050, targeting 19482 and 19600 and 19700.

Brands fundamentals, last week's fundamentals, the remarks of the US president are still the main factor in market fluctuations. His capricious remarks have brought the global market into a process of wide fluctuations. At the beginning of the week, the remarks of the Fed's chairman made the U.S. index and U.S. stocks and U.S. bonds three times, said on Tuesday that they had no intention of firing Powell and said the stock market had risen well. So the market reversed instantly, and the India-Pakistan conflict in the second half of the week increased market tension. Although the situation has eased under the mediation of many countries, the final solution of the problem still requires solving the local terrorism problem. This week's fundamentals mainly focus on the US Dallas Fed Business Activity Index in April at 22:30 on Monday. On Tuesday, we focused on the monthly rate of the US FHFA House Price Index in February at 21:00 and the annual rate of the US S&P/CS20 major cities without seasonal adjustments in the US. Then look at the US March JOLTs job openings and the US April Consultative Conference Consumer Confidence Index. On Wednesday, we focused on the number of ADP employment in the United States in April at 20:15. This round is expected to be 108,000, and the previous value is 155,000. Then look at the 20:30 quarterly rate of the U.S. Labor Cost Index and the initial value of the U.S. real GDP annualized quarterly rate in the first quarter and the initial value of the U.S. real personal consumption expenditure quarterly rate in the first quarter and the initial value of the U.S. core PCE price index annualized quarterly rate in the first quarter. Then look at the Chicago PMI in April at 21:45, and look at the annual rate of the core PCE price index in March at 22:00 and the monthly rate of personal expenditure in March at 22:00, as well as the monthly rate of the existing home contract sales index in March at the United States and the monthly rate of the core PCE price index in March at the United States. Look later at 22:30 U.S. to April 25 EIA crude oil inventories and U.S. to April 25 EIA Cushing crude oil inventories and U.S. to April 25 EIA strategic oil reserve inventories. On Thursday, we focused on the number of initial unemployment benefits in the United States from 20:30 to April 26. Look at the final value of the US S&P Global Manufacturing PMI in April at 21:45 later, look at the final value of the US April ISM Manufacturing PMI in April at 22:00 later and the monthly rate of construction expenditure in March. Pay attention to the initial annualized value of the euro zone's April CPI rate at 17:00 on Friday. Looking at the unemployment rate in the United States at 20:30 later, the US April unemployment rate and the non-farm employment population after the seasonal adjustment in April are expected to be 4.2% and 135,000 people in the previous round are worth 228,000. Look at the monthly rate of factory orders in the United States at 22:00 a little later.

In terms of operation, gold: After the short position of 3496 and 3468 and 3442 were reduced last week, the stop loss followed up at 3400. After opening high today, the market fell back and gave a 3275 long stop loss of 3269. The target is 3310 and 3318 and 3324 and 3332. If the pressure can be broken, look at 3340 and 3345-3350 pressures to leave the market and prepare for weekly short positions.

Silver: 33.55 short stop loss today is 33.7, and the target below is 32.75, 32.5 and 32.25 to leave the market.

Europe and the United States: Today, we will first fall back to 1.12950 and try long, stop loss 1.12750, and target to leave the market near 1.13650 and 1.13850 and 1.14100 and 1.14350 to prepare for short.

U.S. crude oil: After reducing positions at 62.5 last Friday, the stop loss followed at 62.4, 62.9 today, the stop loss at 62.4, the target is 63.2 and 64 and 65.2, and the break is 65.6 and 66.

Nasdaq: Today is 19150 and the stop loss is 19050, the target is 19482 and 19600 and 19700.

The above content is all about "[XM Foreign Exchange Market Review]: Profit settlement lightning rod, gold and silver continue to be high altitude", which was carefully xm-forex.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

Due to the author's limited ability and time urgency, some of the articles areThe content still needs to be discussed and studied in depth. Therefore, in the future, the author will conduct extended research and discussion on the following issues:

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here