Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

location: Home > News > market analysis

market analysis

market analysis2025-09-10

US non-farm employment data is significantly revised downward, focusing on US in

On September 10, during the trading session of the Asian market on Wednesday, spot gold trading around $3,638 per ounce. The gold price continued to rise on Tuesday, hitting a record high of $3,674.36 in the session, as the market generally expected the Federa...

market analysis2025-09-10

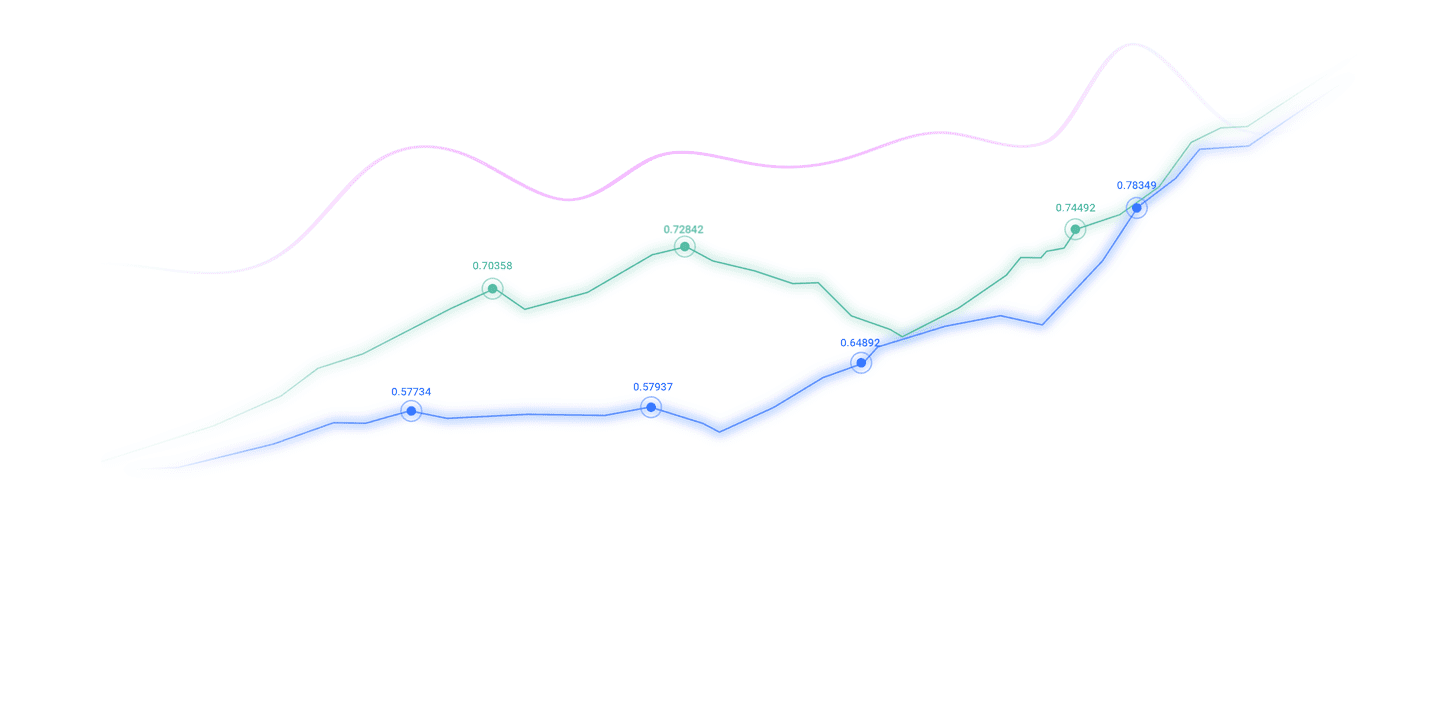

Practical foreign exchange strategy on September 10

USD Index: The USD index rose below 97.85 on Tuesday and the decline above 97.25 was supported, meaning that the USD may maintain an upward trend after a short-term decline. If the US dollar index falls above 97.40 today and stabilizes, the target of future ma...

market analysis2025-09-10

The dollar has collapsed to the bottom of 7 weeks, and the decisive battle is se

The pound fluctuated and rose against the US dollar on Tuesday (September 9), reaching 1.3582 at one point, continuing the rise in the previous three trading days, mainly benefiting from the weakening of the US dollar. The US dollar index is currently trading ...

market analysis2025-09-10

9.10 Gold rose and fell in early trading at 40 and started a good start today.

Your profit comes from other people‘s losses. In other words, when someone makes mistakes, the market will have profits that can be earned by others, but you cannot calculate and predict how many people will make mistakes and how big the mistakes will be made ...

market analysis2025-09-10

Supply concerns support oil prices, can we confirm the upward trend?

On Tuesday (September 9), crude oil futures prices rose slightly, with an intraday increase of nearly 1%, affected by the lower-than-expected increase in OPEC+, China‘s continued reserve of crude oil, and the resurgence of geopolitical risks related to Russia....

market analysis2025-09-10

What should bulls worry about before gold reaches 3700, and what else can bears

On Tuesday (September 9), spot gold XAU/USD continued to break the upper level, hitting a record high of $3,660 during the session, and the US market hovered around $3,650 in the early trading. The overall weakening of the US dollar is intertwined with the dow...

market analysis2025-09-10

The US dollar index remains volatile, and the market focuses on U.S. inflation d

In Asian session on Wednesday, the U.S. dollar index hovered below the 98 mark, with the U.S. dollar rising against most currencies except the yen on Tuesday, regaining lost ground in the previous trading day, and investors consolidated their positions before ...

market analysis2025-09-10

Employment collapse pushes risk aversion, gold and silver are inverted and more

Yesterday, the gold market surged and fell. In the morning, the market fell first and gave a position of 3636.1. The market fluctuated strongly. At the beginning of the US session, the daily line reached the highest position of 2374.7. After the market fluctua...

market analysis2025-09-10

Focusing on US inflation data, Israeli troops launch an attack on Hamas leaders,

Basic news on Wednesday (September 10, Beijing time), spot gold trading was around $3,638/ounce, and gold prices continued to rise on Tuesday, hitting a record high of $3,674.36 during the session, as the market generally expected the Federal Reserve to cut in...

market analysis2025-09-09

Non-farm data collapses, and the Fed's interest rate cut in September is a foreg

XM: The non-agricultural data collapsed, and the Federal Reserve‘s interest rate cut in September was almost a foregone conclusion. XM Exchange Review: According to data from the U.S. Department of Labor, the non-agricultural employment population in the Unite...

market analysis2025-09-09

Also benefiting from the Fed's interest rate cut, the euro's gains are far less

XM: Also benefiting from the Fed‘s interest rate cut, the euro‘s rise is far less than gold. The Fed will announce the results of the latest interest rate resolution on the 18th of this month. Mainstream expectations believe that a 25 basis point interest rate...

market analysis2025-09-09

There are constant "black swans" in the global political arena, and today we are

On September 9, the US dollar (USD) struggled to find demand earlier on Tuesday after it fell from its main competitors on Monday. Later that day, the NFIB August Business Optimism Index will appear in the U.S. Economic Calendar. More importantly, the U.S. Bur...

market analysis2025-09-09

Chinese live lecture today's preview

Pinbar is a classic reversal pattern in price behavior: the long shadow means that the price is strongly rejected by the market, and the buying and selling power is instantly flipped. Master pinbar, you can capture the entry point of high winning rate at key r...

market analysis2025-09-09

Political events are transitioning smoothly, the ECB remains unchanged. Can Euro

The US dollar index continued its decline on Monday after the weak U.S. employment report last week, and so far, the US dollar is quoted at 97.32. Overview of the fundamentals of the foreign exchange market 1. The U.S. Senate panel will vote on Milan’s Fed nom...

market analysis2025-09-09

Analysis of the latest trends of gold, USD index, yen, euro, pound, Australian d

Basic news on Tuesday (September 9), the US dollar index was around 97.35; spot gold trading was around $3,655 per ounce. On this trading day, investors will usher in the annual revised data of the United States non-farm market, which is expected to trigger a ...

CATEGORIES

News

- 【XM Market Analysis】--USD/JPY Analysis: The Buy Strategy Remains in Place

- 【XM Decision Analysis】--BTC/USD Forecast: Remains in a Massive Range

- 【XM Market Analysis】--Gold Analysis: Will it Continue to Rise?

- 【XM Decision Analysis】--Dax Forecast: Continues to Hang onto Support

- 【XM Decision Analysis】--GBP/USD Forecast: Pressure Upside Break Out

- 【XM Market Analysis】--BTC/USD Forex Signal: Struggles at $100K